The Misconception

It is a common misconception that high debt, deficit, and inflation are bad for society.

The truth is that in the right amounts, these three things can help to fuel economic productivity and economic activity. But when they get out of control, they become very dangerous indeed.

This article discusses the relationship between debt, deficit, and inflation, how these three things work, why they’re essential, some potential risks associated with them, and finally, what we can do about it all!

We’ll cover:

- Deficit and Deficit Matters

- Quantitative Easing and Rising Debt Ratio

- How Bad is Inflation?

- Monetary Policies from a Limited Government

- The Devastating Impact and Solution

Debt and Deficit Matters

Debt and deficit are essential for economic growth. The real risks are when debt is mismanaged with too much debt relative to assets or income.

Economic growth requires that the future value of goods and services consumed today to be greater than the value of goods and services produced today. That can mean deficit spending in the present moment to have the productive capacity in the future when there is greater consumption.

But to be productive, resources must be used efficiently.

It’s no secret that the United States is in a bad place right now. We are dealing with an unprecedented level of debt, deficit, and inflation. And this is one of the most critical challenges to chart the future.

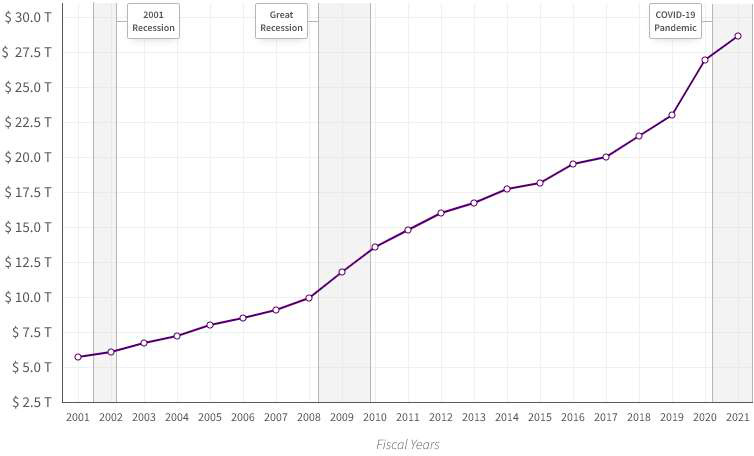

As of Dec.30, 2021, we owe more than $29.5 trillion combined when you consider both public and private debt levels, which means that if everyone should pay off their debts at once, there wouldn’t be enough money in the economy to do it.

Not surprisingly, this level of debt has a significant impact on interest rates and inflation because the cost of the debt and deficits, at this level, is a drain on productivity and capital. In addition, too much deficit-driven stimulus can create inflation and even worse, stagflation.

Bad debt management has caused inflation, higher taxes, making everything more expensive, devaluing savings, shifting money to unproductive investments, taxing retirement funds, and more.

With interest rates at historical lows, we have created Quantitative Easing which plays an essential role in maintaining the stability of the economy and financial markets, but it’s only a temporary and forced solution.

Quantitative Easing and Rising Debt-to-GDP Ratio

The assets purchased with QE are typically long-term bonds and mortgage-backed securities (MBS), which help increase the money supply and help ease financial conditions.

By expanding the federal balance sheet, the government is also lowering interest rates and increasing liquidity within the economy; all of these actions are aimed to help ease conditions and stimulate the economy.

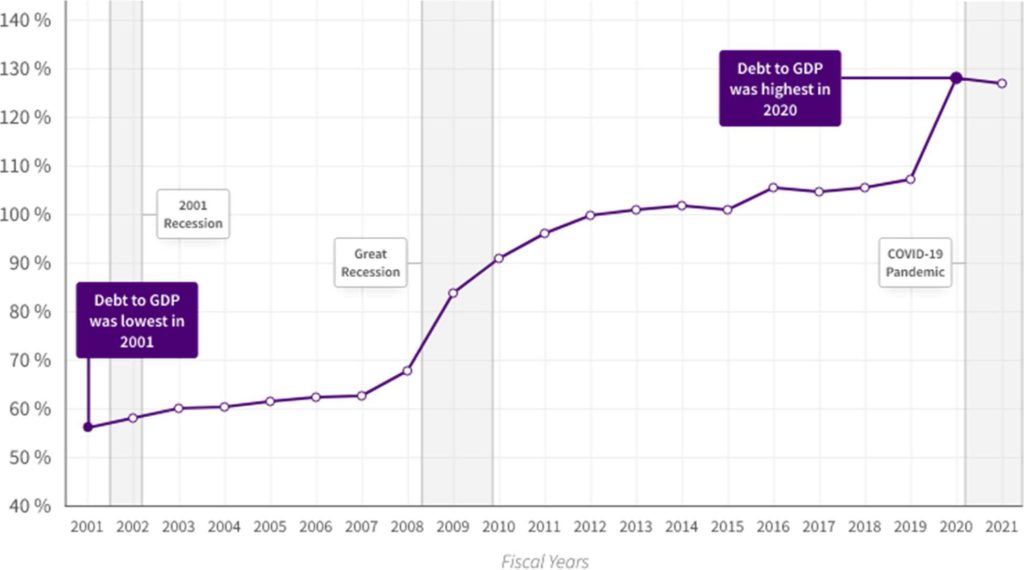

But when the interest rates are low, it increases too much demand for loans, without a 1-1 corresponding effect on productivity because some of the loans are used by non-productive borrowers. All of this coupled with entitlements, government spending, and a lack of will for a balanced budget, skyrockets our debt-to-GDP ratio.

According to the World Bank, if the debt-to-GDP ratio exceeds 77% for an extended period, it slows economic growth. Yet, in Q3 2021, the US had a debt-to-GDP ratio of 122.6%.

For comparison, the US’s highest debt-to-GDP ratio was previously 106% at the end of World War II, in 1946.

Since QE is being used to stimulate, and it is also, in part, inducing inflation simultaneously, it’s only a temporary solution. Once a round of QE stops, major issues will come rushing toward us, even worse than before. The only way out now is to increase interest rates, and lower spending, which could cause stagflation, and further raise the debt.

How Bad Is Inflation?

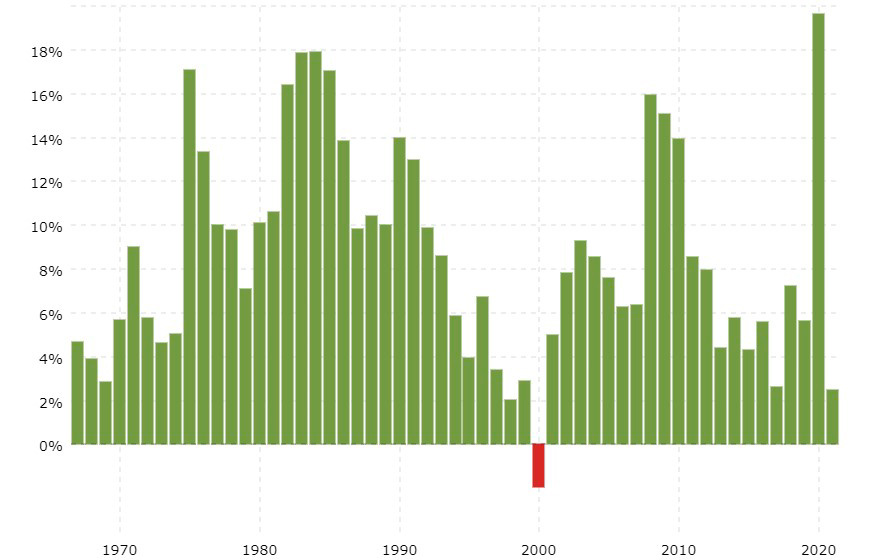

Easy monetary policy and high inflation are two leading causes of currency depreciation. When interest rates are low, hundreds of billions of dollars chase the highest yield. Expected interest rate differentials can trigger a bout of currency depreciation.

The Federal Reserve has kept interest rates at low levels for several years. Many market watchers expect the central bank to raise interest rates over the next few years gradually.

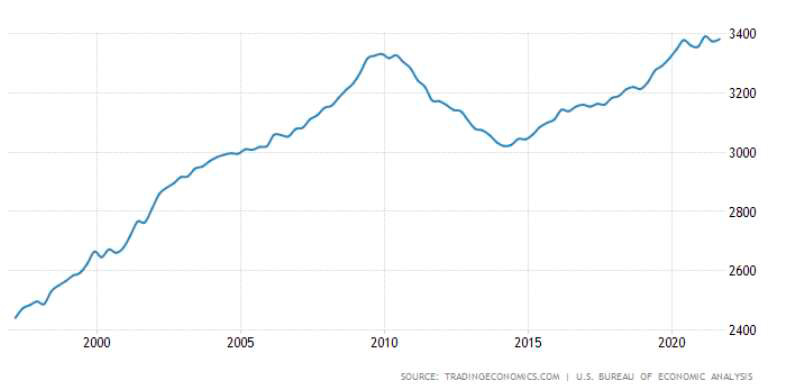

High Inflation erodes the purchasing power of consumers and creditors, reducing wealth and economic production – GDP adjusted for inflation. A decline in GDP will slow the income growth of consumers and reduce currency demand.

Inflation is a normal part of the business cycle, but inflation above 2% typically results from loose monetary policy, a commodity super-cycle, and a strong economy.

Monetary Policies from a Limited Government

Several factors contribute to the risk of debt, deficit, and inflation. And our government policies fuel these because their tools are limited, and they make policy decisions for near-term votes, not long-term economic viability.

The first is increased expenses. Since the financial crisis, federal spending has increased. This means we’ll always print money for rainy days crises. Or rely on large tax hikes and spending cuts. Either way, it decreases the government’s ability to respond to problems.

The second is spending on inefficient infrastructure projects. While government debt cannot be viewed as entirely negative, deficits are caused by overuse of resources or mismanagement of public finances.

Government officials are increasingly using debt to finance construction projects due to falling taxes and rising spending, which is problematic because it leaves little room for error.

When there’s too much debt relative to assets or income, it becomes difficult to repay the loans’ interest without triggering a financial crisis.

The third is the increased demand for loans. Throughout the US, debt has grown by an average of 9.14% per year since 2008. This is primarily due to low-interest rates and increased consumer spending on non-productive items like homes, cars, gadgets, trips, and the likes.

The fourth is quantitative easing (QE). Since QE was introduced in 2009 to stimulate the economy after the financial crisis, it has had a significant impact.

The Federal Reserve has increased its balance sheet so much that it now owns almost 40% of public debt, feeding inflation.

One key consequence is that interest rates are at historic lows, so borrowing money is cheap and easy. But there isn’t enough demand for loans, so the economy is weak.

These contributors are from policies with short-term patches to threaten our economy. If only our government could use more long-term strategies, we can control these better.

The Devastating Impact and Solution

The first significant impact of poor debt, deficit, and inflation management is that savings returns will likely fall, and investment returns will suffer.

There are two main reasons for this: the first is that low-interest rates make it harder to generate a return from savings, and money loses its value due to inflation.

As such, savers will see a fall in their wealth, and investors will struggle to meet their targets.

The second major impact is volatility and the need to take more risks to reach a yield on savings and investments to meet living standards.

For example, following the financial crisis and the subsequent bank bailouts in 2009, many banks would have failed. The effects on the macro economy would be potentially catastrophic without the government’s intervention.

But while the governments are printing money and inflating their debts and deficits, investors worry more about losses and opt for safer investments such as hard assets.

Hard assets, like real estate, will better protect against inflation because of the limited supply, the increase in costs to build new properties, and the increase in rents. Prices will almost certainly go up as inflation picks up and protect against most of the effects of inflation. In many cases, I am certain, as it has for the last few decades, real estate values will outpace inflation and most other investment vehicles.

Even without the risks, through this looming stagflation, real estate may appreciate more than cash and other assets like stocks and commodities because of yield consistency.

The Bottomline

The debt, deficit, and inflation problem has become structural in the United States, with no end in sight. We can only rely on government policy decisions for short-term considerations, not long-term economic viability; it’s up to us as individuals to protect ourselves from these dangers through savings, good policy decisions, and investing choices.