The Power of Discipline and Patience in Investing

“The stock market is designed to transfer money from the Active to the Patient.” – Warren Buffett

If there is one lesson I’ve learned throughout my career, it’s this: money is made by investing for the long term. This applies to stocks, real estate, private equity, venture capital and almost all investments. The ability to stay patient, remain disciplined, and avoid reactionary decisions is what separates those who build lasting wealth from those who merely chase returns.

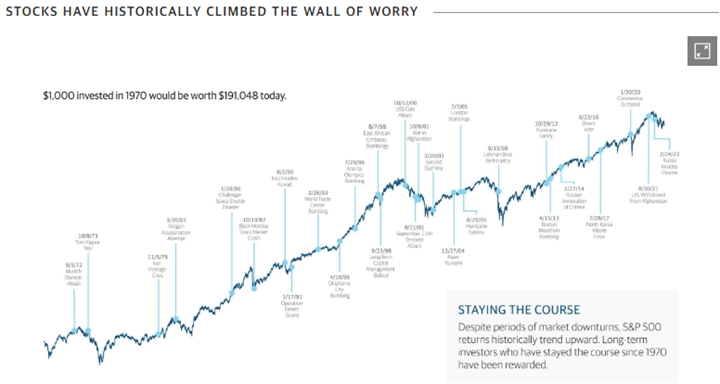

We see it time and time again, markets go through cycles of expansion and contraction. Those who panic during downturns and chase quick wins during booms often find themselves on the losing end. But those who stay the course, manage risk intelligently, and let time do the work consistently outperform.

The challenge? Patience and discipline are easy to talk about but difficult to practice.

The Power of Patience: Why Long-Term Investors Win

The key to long-term success in any asset class, whether real estate, equities, or private investments, comes down to one thing: compounding.

Compounding is often called the eighth wonder of the world, yet most investors fail to fully grasp its power. It isn’t just about the returns you earn, it’s about allowing those returns to multiply over decades.

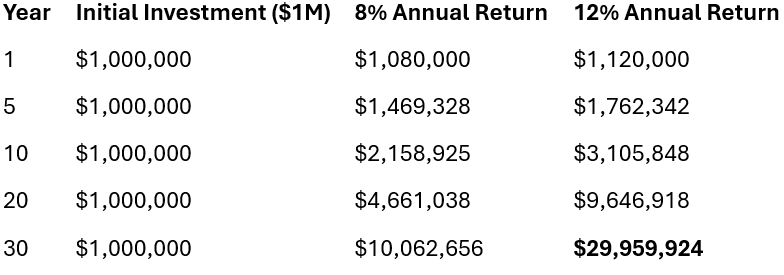

Consider a simple example:

The Impact of Compounding Over Time

The real takeaway? Compounding is slow at first, but over time, the results are exponential.

Unfortunately, many investors interrupt compounding by chasing short-term gains, timing markets, or panicking during downturns. The data is clear: those who stay invested and disciplined see far better outcomes than those who trade based on emotion.

The Cost of Impatience: Missing the Market’s Best Days

If patience is the foundation of wealth-building, discipline is what protects it. Again, this applies to almost all forms of investing.

One of the most common mistakes investors make is trying to time the market, jumping in and out based on short-term trends. But history has proven that missing just a handful of the market’s best-performing days can drastically reduce long-term returns.

According to Northwestern Mutual, if an investor had put $100,000 into the S&P 500 and stayed fully invested for 20 years, their portfolio would have grown to $638,289 by the end of 2023.

However, if that investor had missed just the 10 best days in the market over those 20 years, their portfolio’s value would have been cut by more than half, falling to just $292,423.

This data underscores two key lessons:

✔ Market rebounds are unpredictable. Some of the biggest gains happen during turbulent times, often right after a downturn.

✔ Timing the market is a losing strategy. Investors who try to guess market tops and bottoms usually miss the periods of highest returns.

Applying This to Today’s Market

Right now, we are in a market environment that requires both patience and discipline.

✔ Rising debt levels and inflationary pressures will lead to structural shifts in asset valuations.

✔ Interest rates are at multi-decade highs, making capital allocation more critical than ever.

✔ Market volatility will test investor confidence, but those who stay disciplined will be positioned to capitalize on opportunities.

We have seen this cycle play out before. Periods of uncertainty create the best long-term investment opportunities but only for those who are prepared.

Final Thoughts: How Investors Can Thrive

In my career, I have seen firsthand that the greatest financial successes don’t come from luck or timing, they come from a commitment to discipline, patience, and intelligent decision-making. I have been on both sides of this, good and bad. Experience has taught me a lot, and I am the wiser for it.

What separates those who thrive from those who struggle isn’t luck or opportunity, it’s the ability to build an expertise, stay focused, avoid distractions, and trust in long-term principles.

The best investors in the world, from Buffett to the most successful real estate developers, share a few common traits: they stick to fundamentals, stay disciplined, ignore short-term noise, and let compounding do the work.

📩 Join our investor list to stay informed on market insights, investment strategies, and wealth-building principles that stand the test of time.