A New Era for Real Estate Investors

The One Big Beautiful Bill Act has restored 100 percent bonus depreciation for qualified assets placed in service after January 19, 2025. For investors in real estate this legislation creates a powerful opportunity. StarPoint Properties is developing strategies that use this change to deliver three key benefits: substantial tax shelters, strong current cash flow and income, and long-term capital appreciation.

How Bonus Depreciation Works

Bonus depreciation allows immediate deduction of the entire cost of tangible property with a recovery period of twenty years or less when it is placed in service. Components such as land improvements, building systems, qualified improvement property, and related equipment can now be fully expensed in year one.

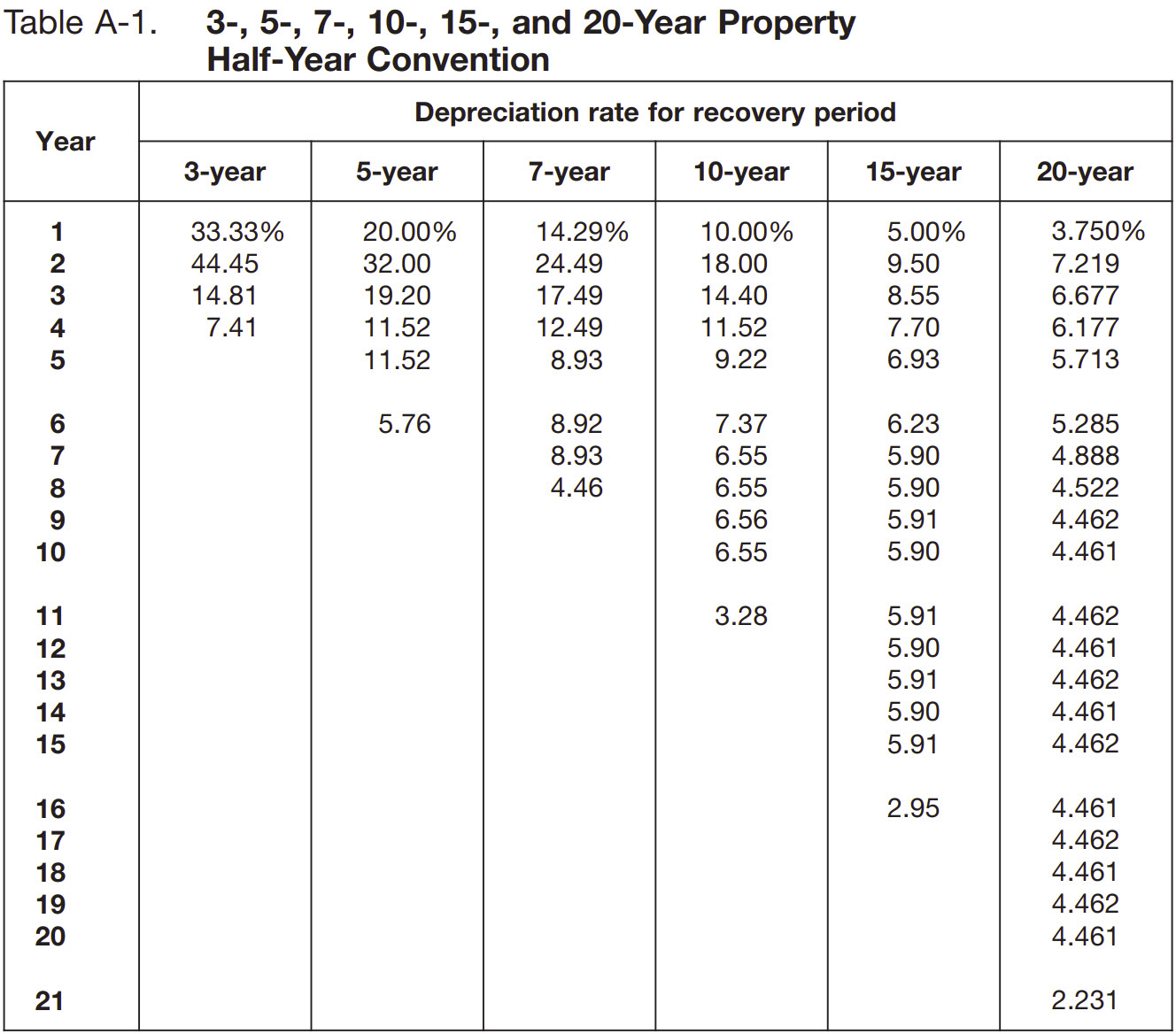

Using IRS MACRS tables as an example, one sees that five-year property yields a 20 percent depreciation allowance in year one, seven-year property 14.29 percent, and fifteen-year property only 5 percent under traditional depreciation for year one. Publication 946 for 2024 contains the official MACRS first year rates for various property classes (IRS Publication 946).

StarPoint’s Strategy: Cost Segregation and Timing

StarPoint employs cost segregation studies to allocate portions of a property into asset classes with shorter useful lives. With bonus depreciation restored to 100 percent, assets that once would have been deducted over multiple years are expensed immediately.

For example, when a multifamily acquisition includes furniture, flooring, roofing, or land improvements, these elements may be identified as five year or fifteen year property rather than lumped into the long 27.5 or 39 year schedule. The result is large deductions in the first year which reduce taxable income significantly.

StarPoint also carefully times when assets are placed in service, ensuring qualifying property is available as early as possible in the investment period. This maximizes the immediate deduction benefit.

The Three Key Benefits for Investors

1. Tax Shelters

Because deductions are front loaded, taxable income is reduced dramatically in early years. Investors gain immediate relief from federal taxes, freeing capital for other uses.

2. Current Cash Flow and Income

By lowering tax liability upfront, investors enjoy higher after tax cash flow. This surplus allows for greater distributions, reinvestment in properties, or faster debt reduction.

3. Long Term Capital Appreciation

Properties in high demand locations continue to grow in value over time. Even as certain components depreciate and are replaced, land scarcity, occupancy trends, and rent escalation drive appreciation that builds long term wealth.

Supporting Data

Graph 1: IRS MACRS First Year Depreciation Rates by Property Class

This chart highlights the first year depreciation percentages under MACRS for five-, seven-, fifteen-, and twenty-year property classes. It shows how shorter life assets produce higher upfront deductions, especially when paired with 100 percent bonus depreciation.

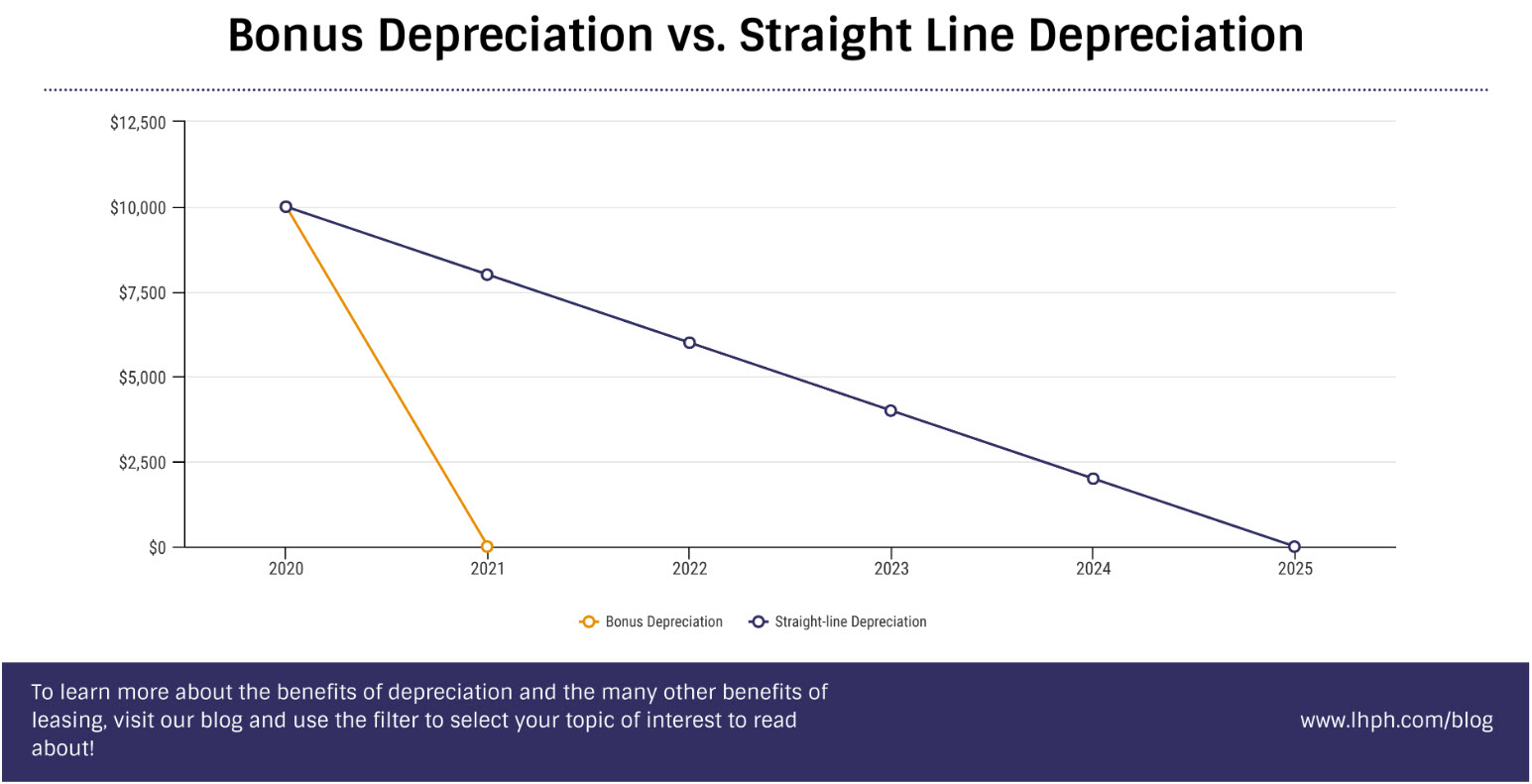

Graph 2: Bonus Depreciation vs. Straight-Line Depreciation

This illustration demonstrates the financial impact of 100 percent bonus depreciation compared with normal depreciation schedules. Under bonus depreciation, the entire deduction is taken in the first year, while straight-line spreads deductions evenly across several years. The chart makes clear how bonus depreciation provides immediate tax savings and boosts investor cash flow.

Managing Nuances and Risks

While the benefits are compelling, implementation requires discipline. StarPoint ensures that cost segregation studies are performed by qualified engineers and tax professionals, meeting IRS standards. We evaluate state level tax conformity, since not all states follow federal bonus depreciation rules. We also plan exit strategies carefully to mitigate depreciation recapture upon sale.

The StarPoint Advantage

Investors partnering with StarPoint should expect in the first year after acquisition or renovation a sharply reduced tax burden, leading to improved after tax cash flow. Over a medium term of three to five years, this boost strengthens property operations and reinvestment potential. Over longer horizons, appreciation in value provides enduring returns.

Conclusion

The One Big Beautiful Bill has created a rare convergence of favorable tax policy and real estate strategy. StarPoint Properties is leveraging 100 percent bonus depreciation to design investments that maximize deductions, strengthen income, and preserve long term growth. For our investors, the outcome is a uniquely powerful combination of immediate tax efficiency and lasting wealth creation.