People say that cash is king, but there are serious threats to its reign. In medieval parlance, you could say the barbarians – rising inflation, massive federal spending and grossly underfunded entitlement programs – are at the gates.

Cash is generally considered a safe investment because it is not as risky as other financial assets. Its value, in other words, doesn’t rise and fall like stocks. This is why when capital markets get frothy or start to take a dive, some worried investors increase their cash allocations. But current economic conditions are turning that notion on its head. “Going to cash” could be a big mistake.

Let’s take a closer look at what I see are the three biggest threats to cash and why it isn’t such a safe investment these days.

Threat #1: Inflation

As a quick Econ 101 review, inflation is the rise in the price of goods and services. Modest levels of inflation can be a good thing, especially because they can boost wages.

But after many years of relatively stable consumer prices, inflation is back in a big way.

The Consumer Price Index climbed by 6.8% in the year through November. It is the highest level since 1982. And, it is also proof that higher inflation isn’t just a temporary symptom of supply chain problems and COVID variants.

What makes inflation so dangerous for cash is that it reduces purchasing power. For example, assuming a 3% inflation rate, $10,000 saved in a bank account today would only buy about $7,500 worth of goods and services in 10 years.

Take it from Ray Dalio, founder of the hedge fund Bridgewater Associates, who said in a recent CNBC interview: “Cash is not a safe investment, is not a safe place because it will be taxed by inflation.”

Inflation is a recurring tax on your cash.

Threat #2: Massive federal spending

The Nobel Prize-winning economist Milton Friedman summed up inflation as the result of “too much money chasing too few goods.”

Where is all that money coming from? Uncle Sam, through massive spending bills and Federal Reserve quantitative easing policies. While some of these moves were necessary to stimulate the economy during the COVID pandemic, there is cause for alarm because of their unprecedented levels.

The U.S. national debt is close to $29 trillion. This will jump higher as the recent infrastructure bill and budget resolution is estimated to cost as much as $2.4 trillion and lead to as much as $4.3 trillion of total borrowing over 10 years, according to the Committee for a Responsible Federal Budget.

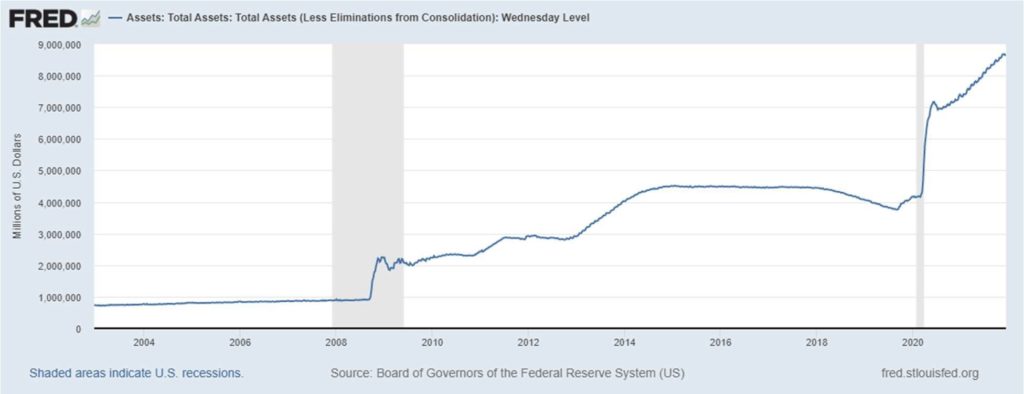

Meanwhile, the total value of assets held by the Federal Reserve has ballooned to more than $8.5 trillion.

Even though the Federal Reserve has committed to reducing its asset purchases, it still has pumped a lot of money into the system, which may do more harm than good. As Dalio said, “You can’t raise living standards by raising the amount of money in credit in the system because that’s just more money chasing the same amount of goods.”

In other words, high government deficits and debt and Federal Reserve printing artificially pump up demand, creating high inflationary conditions. That is what we’re seeing now, which, as noted above, eats away at the value of cash and reduces its properties as a safe investment.

Threat #3: Underfunded entitlement programs

Unfortunately, the government may feel it has no choice but to keep spending and printing. This is because a large portion of the country’s expenses are for entitlement programs, such as Social Security, Medicare and Medicaid.

These programs are in terrible financial health. With fewer present-day workers contributing to Social Security and an increasing number of retirees, benefits have skyrocketed. The Social Security trust fund could run out of money in 12 years. Meanwhile, Medicare’s board of trustees says Medicare’s insurance trust fund that pays hospitals is expected to run out of money in 2026.

The ramifications of these underfunded entitlement programs impact more than those people who receive their services. Government leaders are unlikely to want to suffer the political consequences of letting these programs cut benefits. Therefore, to meet their obligations, the government may have to borrow and spend more or raise taxes, or both.

These actions could lead to the further devaluing of cash, either in higher inflation or higher taxes.

So, what do you do?

Well, this is why you invest. Over time, investment assets such as stocks, bonds and real estate have been shown to outpace inflation much better than cash. While you may not be able to totally avoid inflation, you are better off with a balanced portfolio.

Dalio further said in his interview about the state of cash during high inflation: “You can reduce your risk without reducing your returns. You will not market-time this. Even if you were a great market timer, the things that are happening can change the world, so it changes what could be priced into the market.”

Real estate, for example, can be a good hedge against inflation for several reasons. Property values tend to follow an upward trajectory over time. Real estate can be a source of recurring income. And, real estate investments can appreciate at a level that keeps pace or exceeds inflation.

As investors, we cannot control what the federal government does, but we can control how we decide to react. So, I leave you with a few more words from Ray Dalio, from his book Principles, as he writes: “Time is like a river that carries us forward into encounters with reality that require us to make decisions. We can’t stop our movement down this river and we can’t avoid those encounters. We can only approach them in the best possible way.”