Warren Buffett is one of the world’s most successful and famous value investors. But the Sage of Omaha’s strategy has been out of favor among most other investors who have gorged on growth stocks and nonproductive assets like cryptocurrencies since the Great Financial Crisis.

There’s a good reason for this. Based on S&P data on hedge fund performance, almost 97% of active fund managers underperformed their passive market benchmarks, even last year, when the S&P 500 itself was down 18% and the tech-swollen Nasdaq off by 33%. It’s hard to have confidence in Masters of the Universe who charge outrageous fees yet fail so badly.

Buffett’s $341 billion Berkshire Hathaway, by contrast, was down only about 10% last year, sheltered by long-term holdings in Apple, Chevron, Bank of America, Coca-Cola, and 45 other large, cash-generating stalwarts. His largest holding, Apple, was worth nearly $152 billion at the end of 2022. Buffett focuses on easily understood businesses with strong cash flows and deep “moats” or barriers to entry. His Berkshire Hathaway insurance business throws off significant cash, which gives him a funding advantage when he finds a company that meets his criteria.

Buffet’s Approach to Productive Assets

Buffett is an investor in the mold of Benjamin Graham, who is considered the “father of value investing” and who was one of Buffett’s teachers. In a nutshell, value investing involves looking for productive assets whose share prices are below their companies’ intrinsic values. This contrasts with growth investing, in which company share values often soar above the value of the company itself – hence the rallies and subsequent stock price crashes in fashionable but overpriced companies like Tesla and Meta in 2022.

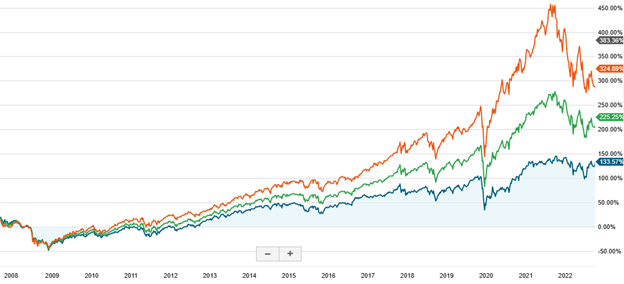

However, the growth investing strategy has outpaced value investing by a large measure since the GFC, as this chart shows. The red line is the performance of the Spider S&P 500 Growth Index. The green line is the Spider S&P 500 ETF. The blue line is the Spider S&P 500 Value ETF.

The red growth index has fallen dramatically since its November 2021 peak, while the value index has been far less volatile. This, value enthusiasts would argue, is why value investors need to be patient and have long time horizons.

Now look at this shorter-term comparison of the Russell Growth and Value Indexes from the Financial Times. Since the market reversal in November 2021, value stocks have been outperforming growth.

Productive Patience Pays Off

If a good company, purchased initially at a price that undervalues it, can be held for years, the payoff is often better than a highly volatile growth stock. Indeed, in his 2021 letter to investors, Buffett reported a compound annual gain from 1965 to 2021 of 20.1%, compared with 10.5% for the S&P 500.

“Productive assets such as farms, real estate and business ownership produce wealth — lots of it. Most owners of such properties will be rewarded,” Buffett wrote. “All that’s required is the passage of time, an inner calm, ample diversification and a minimization of transactions and fees.”

Compare, for example, Buffett’s performance with Cathy Wood’s ARK Invest portfolio of “disruptive innovation” stocks, which fell a ghastly 39% last year. And unproductive assets, such as cryptos, cannot be valued in any rational manner, and are therefore off the menu for value investors like Buffett.

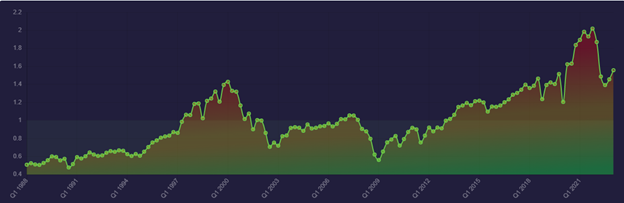

The Buffett Indicator

Buffett points out that the sort of growth-stock outperformance seen in 2020 and 2021 is inherently unsustainable because the value of stocks is constrained by the pace of growth of the economy. His Buffett Indicator is a measure of stock market value based on this idea. The indicator is the market capitalization of all U.S. stocks, using the Wiltshire 5000 index (about $40.7 trillion), divided by U.S. GDP (about $26.1 trillion). As the graph below indicates, this means the market is 56% overvalued.

Surviving Stagflation

Buffett’s portfolio fell like most everyone’s during the GFC, declining about 30% at the worst of the crisis. However, the S&P 500 was down over 55% at one point during the same period. Berkshire’s focus on “conservatively financed” assets might have helped Buffett dodge the worst of the financial sector meltdown. His big financial holdings, after all, include American Express and Bank of America, both of which came through the crisis largely intact.

Since the Buffett Indicator says stocks are still very overpriced, and since the markets have been flat to slightly positive since the fourth quarter of 2022, it is difficult to say how difficult economic conditions could affect Buffett’s opportunities for new investments and investment styles. Rising rates will increase funding costs across the board, for Buffett and any competitors he must bid against for attractive assets. They will also raise the discount rate for future earnings, hurting growth stocks, but not necessarily changing the equation for value.

Meanwhile, inflation, while running too hot for central banks’ comfort, can be passed through to customers in most of the industries in which Berkshire operates. Unless there is a serious economic contraction, on the 4%-plus scale seen during the GFC, it is unlikely that Buffett’s portfolio will suffer much.

Rather, as he wrote in his 2016 investors letter, “During such scary periods, you should never forget two things: First, widespread fear is your friend as an investor, because it serves up bargain purchases. Second, personal fear is your enemy. It will also be unwarranted.”

Or, as Benjamin Graham put it somewhat more tersely, “The investor’s chief problem – and even his worst enemy – is likely to be himself.”