Opportunity zones as they have existed since 2017 are headed for what could be their last year of existence — or the first year of the rest of their life.

The federal program is set to expire next year, but a pending extension or expansion could bring a fresh wave of investment to Los Angeles.

The projects that have been built, like the program itself, haven’t been without controversy.

But local developers and economic development professionals say that the program has helped bring investment to parts of the city that likely wouldn’t have gotten it without the program.

“Before opportunity zones, it was very difficult to get people to want to invest in South Central Los Angeles, Watts, Compton, parts of East LA — very difficult. And it’s still difficult,” SoLa Impact CEO Martin Muoto said.

“When I look at what’s the most effective way to direct capital into low-income communities, the opportunity zones program has been the most effective,” he said.

Muoto acknowledged the shortcomings and criticisms of the program, which was created by the 2017 Tax Cuts and Jobs Act and offers a tax break for those investing in real estate projects and businesses in designated economically distressed areas.

One of the most prominent critiques of the program was that many of the zones are located in areas that aren’t actually disadvantaged. In Los Angeles, parts of Hollywood and Koreatown in opportunity zones weren’t having trouble attracting capital, but they were designated nonetheless.

Developers also used the program to build hotels or market-rate apartments, which critics argued offered negligible benefits for the impoverished people living in these areas but supplied tax breaks to the wealthy investors funding the projects.

The program, which is set to sunset in 2026, got a lifeline on Monday when the House Ways and Means Committee included a provision that could expand and extend the opportunity zone program in its nearly 400-page tax package.

The committee’s draft proposes letting current OZs expire at the end of 2026 and putting new ones into effect on Jan. 1, 2027. More rural zones and fewer urban ones are expected.

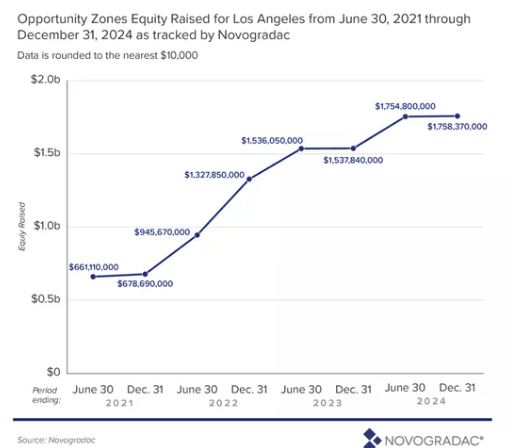

While fundraising for these projects plateaued last year, it was also up compared to 2023, indicating both a continued interest in these projects in Los Angeles and investor optimism that the program will be extended

Investment in Los Angeles’ OZs in the last six months of 2024 was around $1.8B — roughly the same as it was in the first six months of the year and a step up from the roughly $1.5B raised in the last six months of 2023, according to Novogradac.

The enacting legislation didn’t include tracking mechanisms for opportunity zone projects, so it is hard to know exactly how much has been built and where. Novogradac’s count, which tracks more than 2,000 qualified opportunity zone funds, finds that companies have raised more than $40B nationally since the program went into effect.

Of that, the majority has gone into multifamily housing developments, Novogradac estimates. In Los Angeles, the shortage of housing is often named as the culprit behind the city’s affordability crisis. LA was the top city for OZ equity raised in 2023, Novogradac found.

Of Muoto’s roughly 3,500 built and in-progress units, the vast majority are in OZs and offer some form of covenanted affordable housing.

“That would not have been possible without opportunity zones,” Muoto said.

Arctaris Impact Investors provided key project funding for Liv DTLA, an eight-story, 227-unit, all-studio project on Flower Street. The project entered a five-year master lease with the Los Angeles Homeless Services Authority and will provide permanent supportive housing and services within a 100% affordable building.

Arctaris Managing Director and Head of Real Estate Nihar Sait called LA one of the best cities to invest in from an OZ perspective.

“We’re optimistic about putting more capital to work in LA, and I think they’ve done a great job of designating particular areas that are conducive to investments,” Sait said.

StarPoint Properties CEO Paul Daneshrad has a 180-unit project in Long Beach that is fully entitled and ready to begin construction. He has completed projects locally and across the country in OZs. Daneshrad has seen “diminished interest” in the program, which he attributes to investors focused on that 2026 sunset date.

But he also expects that extending the program would revive investor excitement for OZs.

“If they renew the legislation and they make it as attractive as they did before, then there will be renewed interest,” Daneshrad said.

One reason investors need a push is because of Los Angeles’ earned reputation as a challenging place to entitle and build new developments.

“When I talk to people outside of LA, both nationally and globally, they realize how difficult it is to build in LA,” Muoto said.

But the OZ program “motivated capital to take on the risk,” and the program’s 10-year hold period to reap the maximum benefits of the program pushed investors to be patient with projects, which also helped encourage investment, Muoto said.

Additional reporting requirements for OZs to create transparency about its successes and shortcomings and make it easier to track where capital is deployed have been discussed, though it is unclear whether those will materialize.

The potential for reevaluating eligible tracts and proposing new ones was also included in this week’s proposal out of Washington to extend or expand the program. Rethinking which tracts are included is often mentioned as a necessary part of an update or extension to the program.

“As a general rule, for me, increased investment is a good thing,” Los Angeles LDC CEO Michael Banner said. “Now the question is, what kind of investment do you get, and who benefits from it?

“My gut tells me that we don’t know enough to know if it’s good or bad, and without data, I think the program is going to be open for greater criticism,” Banner said.

Contact Bianca Barragán at bianca.barragan@bisnow.com

See Also: REPORT: 26North Nearing Acquisition Of Data Center Investor DigitalBridge

Related Topics: Starpoint Properties, Paul Daneshrad, opportunity zones, Opportunity zones Los Angeles, Michael Banner, Martin Muoto, SoLa Impact, Arctaris Impact Investors, Nihar Sait

Read full Bisnow article HERE