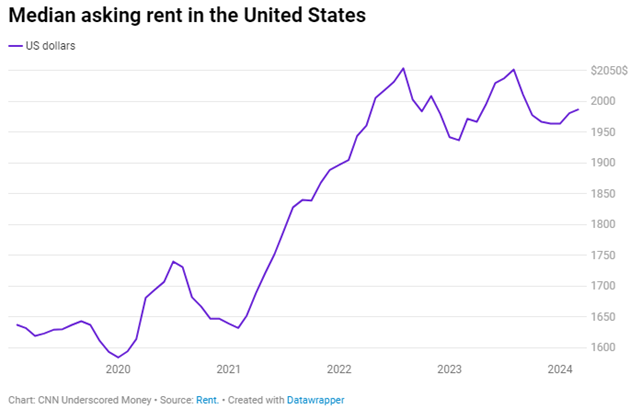

Real estate is a solid anchor for an investment portfolio. After all, the value of stocks and funds gyrates with economic news and trends. Meanwhile, real estate investments just pump out rental income and, when you eventually sell the asset, a big chunk of capital gains.

Within that basic concept lies a spectrum of investing options. You can make real estate investing as easy or as hard as you want, depending on your other financial, life and career goals.

Understanding the basics of real estate investing

Buy and hold; meanwhile, reap rent.

That’s the formula. But it pivots, say real estate investing advisors, on acquiring the right properties at the right time for the right price. Before you wade into real estate investing, be sure you have a strong grasp of the underpinnings of real estate valuation.

Potential investments typically fall into one of three valuation categories, explained Paul Daneshrad, founder and CEO of StarPoint Properties, a private real estate firm, and author of “Money & Morons: How to Build Wealth and Protect Yourself from the Great Conflux.”

Core

A core investment property is in a great location, is in excellent condition and produces high and reliable rental income. Such an investment can yield 6% to 12% annually in total returns. (The total return is the annualized return of cash from operations plus the value you reap when the property is eventually sold.)

Value add

The middle tier is the “value add” property. It is in a solid but not spectacular location, might need some polishing to attract a fresh crop of tenants and produces a decent return, likely a total return of 8% to 15% annually.

Opportunistic

And then, there’s the “opportunistic” property, which delivers 12% to 30% in annual returns but has a location that must be offset by significant improvements and likely must attract a completely new set of tenants to fulfill its promise, said Daneshrad.

Real estate investment strategy is grounded in making the most of the potential inherent in each of these categories — whether you apply the strategy to a house on the next block you’d like to own and manage or to the portfolio of a real estate fund.

Introduction to real estate investment trusts (REITs)

A real estate investment trust is a type of fund that buys, manages and sells real estate investments. Exactly what kind of real estate the trust holds is spelled out in its prospectus. Some REITs are bought and sold on the market, which makes them as liquid as any other type of fund. Other REITs are built and managed by private real estate investment companies. Often, private REITs deliver returns to investors on a set schedule and only allow investors to cash out at certain points. That means, if you buy into a privately run REIT, you must be sure you can afford to let your money stay locked up until the fund matures.

“The benefit of a REIT is that you don’t have management responsibility,” said Daneshrad. “The downside is that you’re paying management fees, and you don’t get the tax benefits of owning real estate.”

Management fees for private REITs usually run about 1% to 2% annually. Usually, REIT returns are taxed like ordinary income, but a portion may also be taxed as capital gains or return of capital. Calculating taxes on REITs is typically more complicated than stocks, so always confirm the tax implications of any investment with your tax accountant.

Guide to online real estate investing platforms

A good way to become conversant with real estate investing is to haunt online investing platforms, comparing the types of properties and portfolios offered at RealtyMogul and similar sites. The paperwork that explains a property, its potential and what managers must do to tap that potential is found in the accompanying disclosure and prospectus.

Jamison Manwaring, co-founder and CEO of Neighborhood Ventures, a platform that specializes in affordable housing, said that when you become familiar with the analysis that professionals apply to smaller properties, you learn how to evaluate individual properties you might consider buying on your own.

One factor to look out for is the “promote,” which is an extra cut of the profits earned by the lead sponsor. If you buy a property on your own and manage it, you have earned your own promote, above what any silent partners might claim, he said. The structure of deals offered at online platforms can also acclimate you to the likely timeline, too, said Manwaring. “Real estate returns can take years,” he added.

How to invest in rental properties

Rental properties are a classic way of gaining a foothold on the first rung of the property ladder. A key decision is how much of your own time and energy you want to spend managing the property. A professional manager will relieve you of the tedium of maintenance and repair but at a significant cost.

Daneshrad is a fan of the owner-occupied rental strategy. “Buy a two- to four-unit building, and live in one unit,” he said. A properly constructed deal will yield cash flow from the tenants that covers your living unit, too. You’ll have to manage the costs of property ownership, from taxes to insurance to an improvement fund, but the scale is only a little larger than doing the same for a single-family house, Daneshrad pointed out. If you like the arrangement, move yourself up to bigger properties. If you don’t, you can cash out and move to a dwelling that is more compatible with your goals.

Basics of property flipping

Property flipping reverses the classic “buy and hold” strategy of real estate investing: You buy a property that has a lot going for it but is sorely in need of updating, then complete the renovation as quickly as you can so you can sell the property for a fast profit.

It’s stressful enough to flip a property using only your own money, but many flippers rely on short-term loans to cover the purchase and renovation expenses. Racing the calendar to get the property renovated and back on the market is an adrenaline-charged exercise. Speed is a priority for you, but your goals might not be shared by the contractors you must rely on to complete the work and pass crucial inspections. Real estate investing advisors say that buying and renovating your own house, over and over again, is a less frenetic way to flip properties. You can make the most of advantageous mortgage and tax terms available only to owner-occupants. But, you’ll also be living in a continuous construction zone.

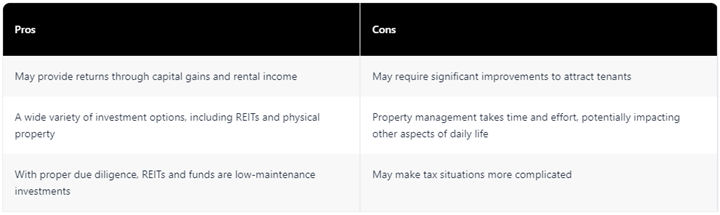

Pros and cons of different real estate investment strategies

The math of real estate returns is usually straightforward: rental income plus capital gains equals your gross gain, minus management fees, taxes and the carrying cost of the property.

But the off-balance-sheet factors count, too, say real estate investment experts. The more involved you are directly, the more the investment affects your career, relationships and lifestyle goals. You might make more money if you manage the property on your own, but you will still need to work with professional contractors and financial advisors.

Funds and REITs may offer a true “armchair investment” — if you fully research the experience and track record of the portfolio managers, and if investing in a REIT is compatible with your other investments, your long-term goals and your household cash flow.

Tax benefits of investing in real estate

Real estate is “one of the most tax-efficient investments,” said Daneshrad, but tax advantages depend on the form of investment.

Directly owning real estate — on your own or with partners — sets you up for depreciation that can offset other income.

Tax policy offers a special break for real estate owners and investors — the “1031 Exchange.” This Internal Revenue Service (IRS) rule lets you sell a property and then immediately buy another property without paying taxes on the sale. By rolling the capital gain from a property right into your next real estate investment, “you can buy something bigger that has even more income. That also will depreciate, though rents continue to go up,” summarized Daneshrad of the forward momentum of this kind of maneuver.

But, to capture the tax benefits offered to real estate owners, you must invest in appropriately structured investments. If the tax benefits are important to you, work with a real estate tax accountant before you buy into the investment.

Steps to get started with real estate investing

At a high level, consider these steps to get started with real estate investing:

- Do your homework: Become familiar with how real estate delivered — or didn’t — for investors through economic ups and downs, recommended Daneshrad, so you fully understand the implications.

- Work with a trusted partner: Align with investors who’ve weathered real estate booms and busts, he said.

- Choose the right deal: Take the time to immerse in the structures of real estate investing options, advised Manwaring, so that you don’t find yourself struggling to extract from a deal that is incompatible with your life and investing goals.

Frequently asked questions (FAQs)

How much money do you need to invest in real estate?

Publicly traded REITs are easily traded in brokerage accounts, just like stocks. Most don’t charge anything to open an account but may require a minimum of a few hundred dollars to start buying securities. After you’ve opened and funded an account, reading REIT disclosures and prospectus statements is a good way to become familiar with real estate valuation, expected returns and risk factors.

What is commercial real estate and how do you invest in it?

Commercial real estate is rented to business tenants. Office buildings, warehouses, distribution centers and manufacturing facilities are all commercial uses. Multifamily complexes, which have many units leased to individuals or families, fall under a separate category of real estate investment.

What’s the best way to invest $10,000 in real estate?

The best way to invest any sum is to first review your long-term financial goals and the progress you are making in achieving those goals. If you are maximizing the options available through your employer’s retirement plans (including claiming the full match from your employer), consider opening a self-directed individual retirement account (IRA) where you can park and invest cash while you explore options for buying into real estate. While IRS rules prohibit you from using IRA money to buy the house you live in, you may use IRA funds to invest in real estate. Always work with a real estate lawyer and a financial advisor to vet any real estate investments.

What is digital real estate and how do you invest in it?

Online assets that have web addresses, such as domain names, URLs and blogs, are a form of business investment, but please do not confuse digital assets with real estate in the analog world. Online companies hoping to attract investors’ attention and money might call their products “digital real estate,” but assets that exist only on the internet are not the equivalent of real-life real estate.

Editorial Disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airlines, hotel chain, or other commercial entity and have not been reviewed, approved or otherwise endorsed by any of such entities.

This content is for educational purposes only and is not intended and should not be understood to constitute financial, investment, insurance or legal advice. All individuals are encouraged to seek advice from a qualified financial professional before making any financial, insurance or investment decisions.

Note: While the offers mentioned above are accurate at the time of publication, they’re subject to change at any time and may have changed or may no longer be available.

Link to original article HERE