Author: Taylor Trautloff

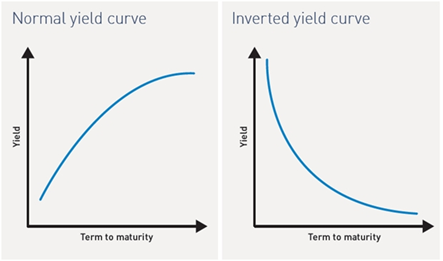

What is an Inverted Yield Curve

An inverted yield curve is when short-term interest rates exceed long-term interest rates. Typically, longer-term interest rates are higher than short-term rates because there is more inflation risk and uncertainty in the distant future compared to the near-term future and investors need to be compensated for this risk.

Why Is This Relevant Now

Starting in September 2023, the yield curve began to “un-invert.” The yield curve has been inverted for the last 15 months. On July 5th, 2022, the yield curve between the two-year and the ten-year Treasury bonds inverted and it has remained this way ever since. However, in the last couple of months, the spread between the two-year and the ten-year is narrowing and the yield curve is beginning to flatten.

In the graph below, the ten-year UST is in green, and the two-year UST is in blue. If you look at 2022 to early 2022, the ten-year UST (in green) is above the two-year UST (in blue) and during these years, the yield curve was normal. Today, the two-year is at 5.083% and the ten-year is at 4.926% which means that the yield curve is still inverted (CNBC). Now, the spread between the two-year and ten-year is beginning to narrow and this is shown in the graph below.

The Yield Curve as a Recession Indicator

An inverted yield curve is significant because an inverted yield curve has preceded every recession, with a lag time of as little as seven months or as long as two years (Barron’s). All nine recessions since 1955 were preceded by an inverted yield curve. Since 1955, there has only been one false positive, i.e., when the yield curve inverted, and a recession did not follow (Fortune). In the mid-1960s, the U.S. government was fighting inflation amidst strong GDP growth, low unemployment, and high federal government spending. The Federal Funds rate went from 3.5% in 1964 to 5.75% in 1966. After the fed raised rates, the yield curve inverted, and U.S. GDP growth stayed positive and fell to 0.3%. Unemployment remained low at 3.8% and the stock market went on a bull run from 1966 to 1967. The federal reserve managed to pull off a “soft landing” which is when inflation is curbed without causing a recession. The question is, can the Federal Reserve still pull off a soft landing today?

How the Yield Curve Un-Inverts

The yield curve can un-invert in two ways. A bull steepener is when the two-year rate falls faster and lower than the ten-year rate. A bear steepener is when the ten-year rate rises faster than the two-year rate. A bear steepener has only occurred a handful of times throughout the last century and in all scenarios, it preceded a recession.

A bear steepener indicates that the Federal Reserve will keep rates elevated for longer. This movement in the bond market implies that interest rates will remain high for longer than initially expected (Barron’s). In turn, this increases corporate borrowing costs and companies cut spending through layoffs. High rates impact the stock market since the risk-free rate increases, meaning, investors need to be compensated for taking on additional risk because the “risk-free rate”, the U.S. treasury rates increased (Reuters).

How This Relates to Real Estate

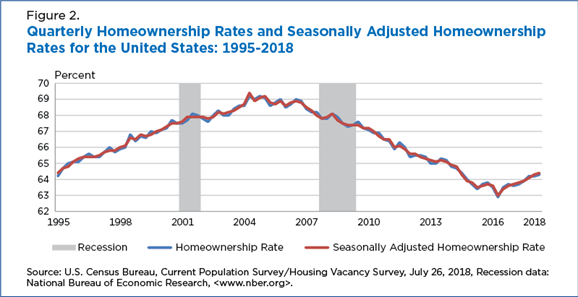

Bill Gross, the co-founder of PIMCO, otherwise known as the “Bond King”, tweeted in early October that the U.S 30-year mortgage rate hit 7.7% and this is shutting down the housing market. However, the impact of high rates on multifamily real estate is nuanced. Elevated rates are pricing out new homeowners and creating a new permanent renter class. U.S. homeownership peaked in 2006 at 69% and has been on a decline since then (Wall Street Journal). Homeownership has been in a gradual decline despite record low rates and a housing bull market. The meteoric rise in interest rates is the nail in the coffin. Every year, millions of Americans that would’ve transitioned from being renters to homeowners are electing to remain in apartments. The overall fundamentals of investing in multifamily real estate are strong.

Additionally, the recent bear steepening of the yield curve implies that inflation will remain elevated for longer than originally anticipated. Commercial real estate is traditionally viewed as a hedge against inflation, as values tend to appreciate at the same rate of inflation. With traditional commercial leases, the tenant bears the operating costs, so the rise in costs is passed on to tenants. Inflation also leads to an increase in the price of labor and construction materials and this upward pressure on costs ultimately reduces the supply of new construction.

The bond market suggests that interest rates will remain elevated over the long term. If this is the case, investing based on fundamentals and finding undervalued real estate assets will be more important than ever. Warren Buffett once said, “I make no attempt to forecast the market, my efforts are devoted to finding undervalued securities.”

Sources

https://www.barrons.com/articles/stock-market-treasury-yield-curve-inversion-f366e665

https://fortune.com/recommends/investing/the-inverted-yield-curve-recession/

https://www.wsj.com/articles/BL-REB-33649

https://www.cnbc.com/quotes/US2Y

https://www.chicagofed.org/publications/chicago-fed-letter/2018/404

https://www.cnbc.com/2023/07/07/yield-curve-inverted-the-lowest-since-1981-what-it-means-for-yo.html

https://www.marketplace.org/2023/09/07/inverted-yield-curve-signals-a-recession-wrong/

https://www.barrons.com/articles/yield-curve-inversion-stocks-recession-2c3616ab

https://www.nasdaq.com/articles/the-inverted-yield-curve-what-it-means-and-how-to-navigate-it