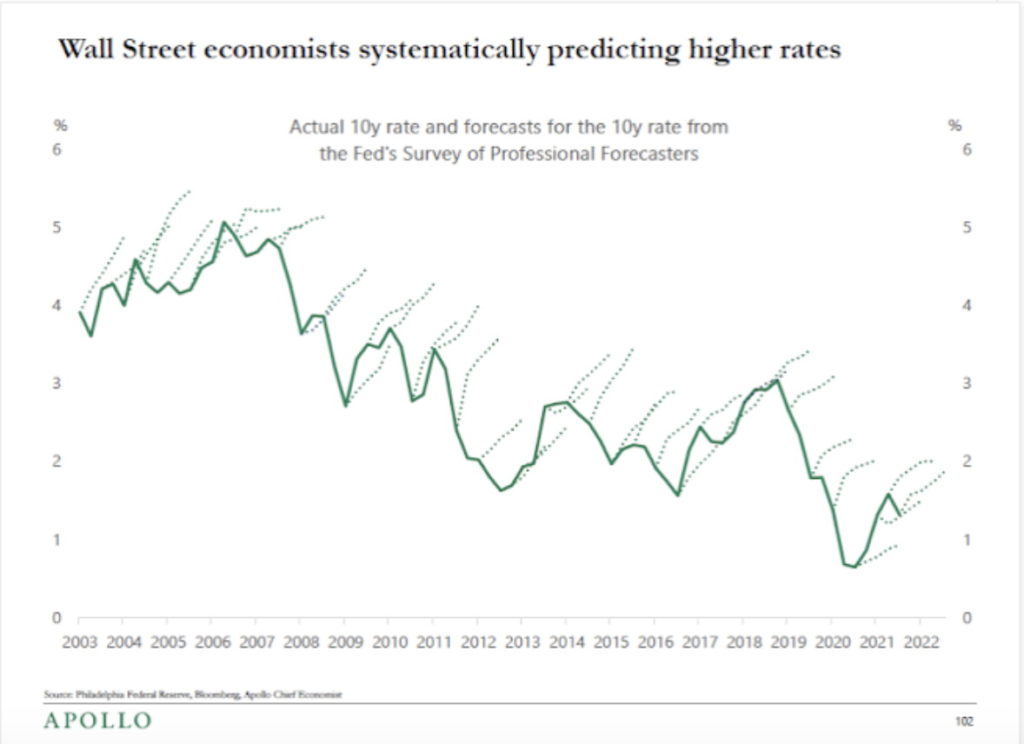

The macroeconomics profession has had a tough time in the prediction game in recent decades, in particular by chronically forecasting pending higher inflation and interest rates, ever since Reagan was Reagan.

Yet even after decades of misses on the high side, the profession still doubled-down repeatedly over the last 10 years; witness this interest rates chart from the excellent Grumpy Economist blog by Stanford’s Hoover Institution economist John Cochrane:

So, the question becomes, “Why believe that higher inflation and interest rates are now imminent for the US economy?”

This Times Does Look Different When it Comes to Inflation and Interest Rates

While it is true that the current leadership of the US macroeconomics profession may be stuck in the disco-1970s, there have been trends in both M2 growth and in the price indices that do make this cycle look different from the past few decades. Even broken clocks are right occasionally, and this may be one of those times.

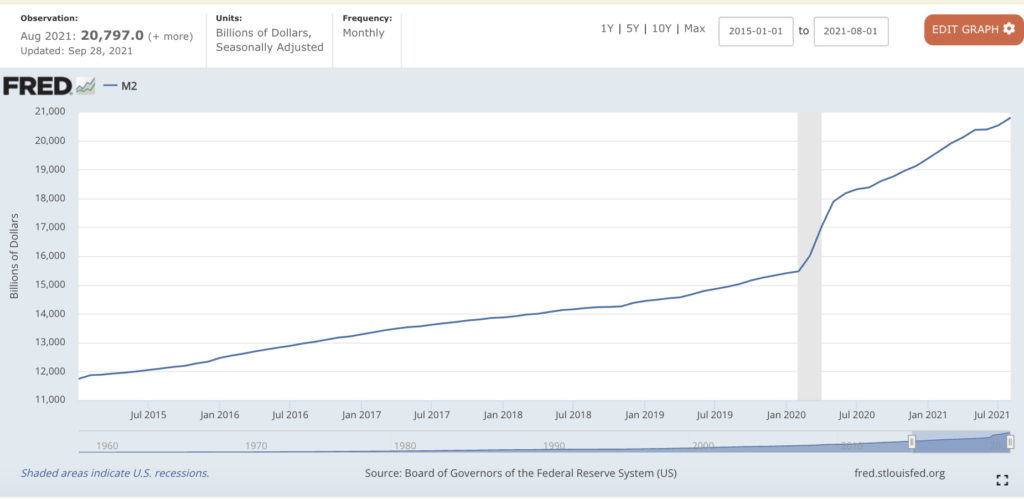

M2 Growth

Let us consider the growth of the US money supply, as gauged by M2:

Yes, the “hockey stick” metaphor applies to M2, or the most-used definition of the money supply. The takeaway is that the US M2 money supply has risen by about 33% since the beginning of 2020. True, all the old arguments about slowing velocity apply but, nevertheless, this is a historic expansion of the money supply that, in a vacuum, devalues the dollar.

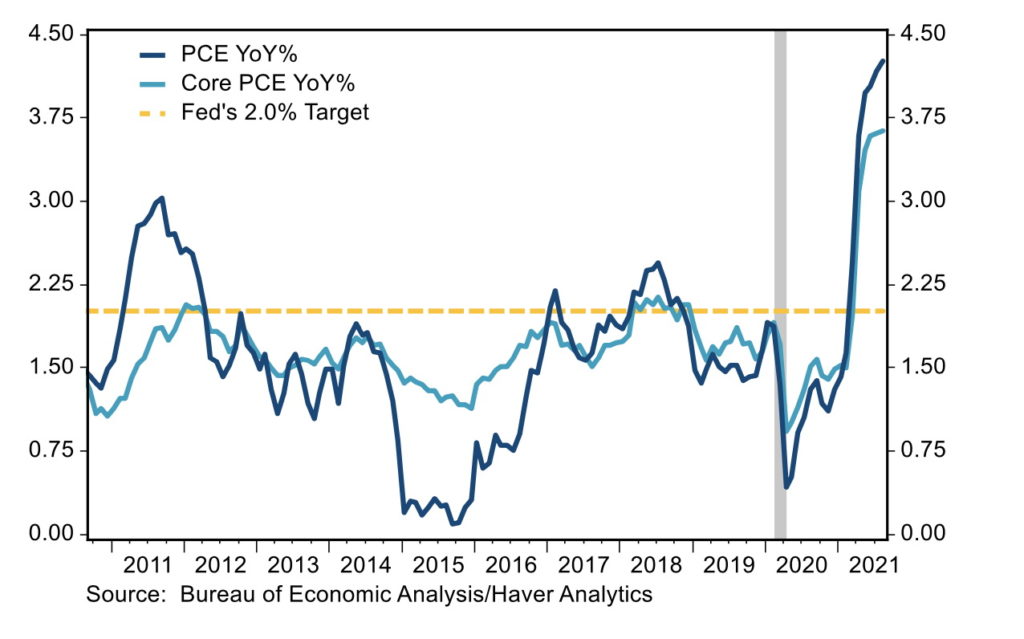

Inflation

After the devastating stagflation of the 1970s, inflation normalized and has averaged approximately 2.90% annually over the past 40 years. Despite remaining “well-behaved” for the last 10 years or so, we now see the inflation rate in 2021 beginning to bulge again, even more so than in 2011 after the monetary stimulus applied during the Great Recession caused a bump-up in prices.

US PCE Annual Rate of Inflation:

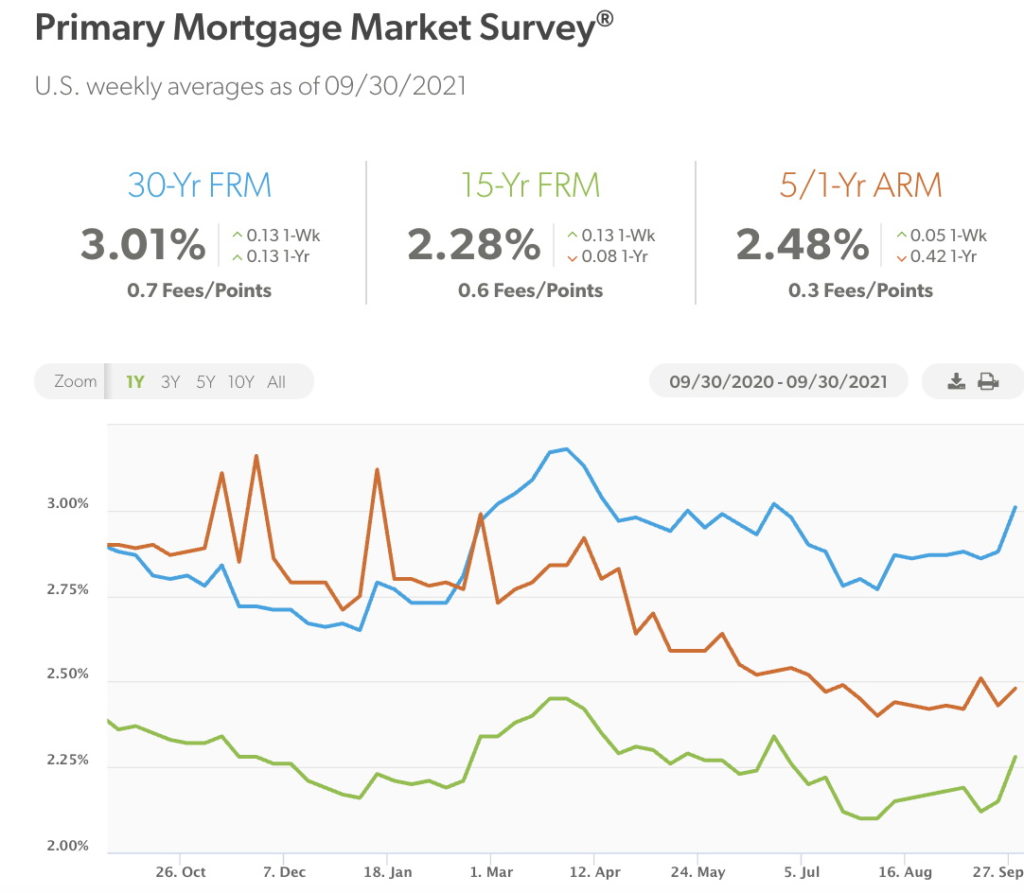

Perhaps not surprisingly, interest rates are showing signs of life as well:

The month of August sure looks like a bottom.

Planning Ahead

The good news is that commercial banks and financiers have plenty of cash to lend, sitting atop unprecedented amounts of reserves, thanks to the Federal Reserve’s bond-buying, quantitative easing programs.

Before 2008, economists used to talk about “excess reserves” and that banks could not lend beyond the restrictions imposed by their reserves, or the capital cushion required by law against loan losses.

But today the term “excess reserves” has become antiquated, as banks sit atop trillions of dollars in deposits, and are limited only by loan officers’ sentiments. Evidently, loan officers like what they see.

Indeed, “Commercial and multifamily mortgage bankers are expected to close $578 billion of loans backed by income-producing properties in 2021 – a 31% increase from 2020’s volume of $442 billion, according to the Mortgage Bankers Association’s (MBA) newest forecast,” reported Mortgage Orb in early October.

Planning Ahead for Inflation and Interest Rates

For commercial building owners, including those in the office market, all of the above suggests it is a good time to “lock-in” or borrow long at a good, low rate and then shift potentially rising costs onto tenants to the greatest extent possible.

Some potential hedging steps to take include —

- Indexing leases to the CPI, particularly longer-term leases, or signing only shorter leases for the next couple years, as the inflation picture shakes out.

- Shift operating expenses to tenants, such as janitorial services, utilities and so on, especially through triple-net leases (leases in which the tenant agrees to pay all the expenses of the property, including property taxes, building insurance, maintenance and utilities). Those expenses can be expected to rise with higher rates of inflation.

Conclusion

There is likely good news for office markets globally and in the US, or so at least reports Cushman & Wakefield. While the Delta variant of the COVID-19 pandemic has been a setback on the road back to normalcy, nothing lasts forever, and between inoculations and infections, herd immunity is being obtained.

“At the current rate, most of the world will achieve herd resiliency—i.e., over 70% either vaccinated or infected—by Q2 2022,” says Cushman & Wakefield. “We conclude that most office workers globally will be able to return to the office in the first quarter of 2022.”

So, the present is a perfect time to re-shape leases to the possibilities of sustained inflation, and to lock-in the still low mortgage rates that may disappear in a few seasons hence.