Periods of market volatility reveal a fundamental divide in commercial real estate: the difference between skilled operators and those who benefited from favorable market momentum. When capital is abundant and values are rising, nearly any strategy can succeed. In contrast, during a reset, when liquidity tightens, risk gets repriced, and fundamentals matter again, the true strength of leadership becomes visible.

The Nature of the Current Reset

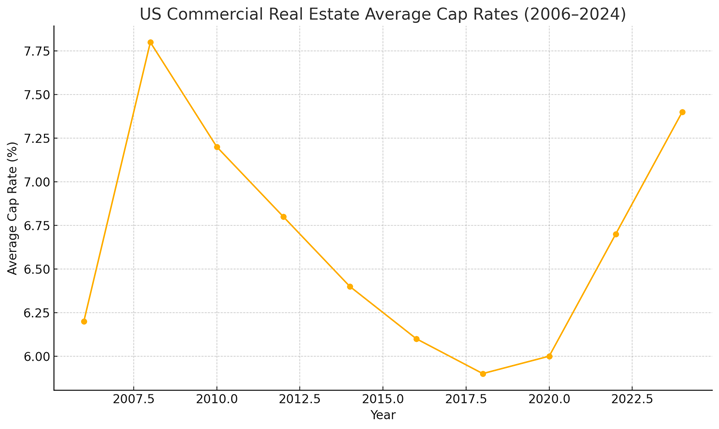

The current correction in commercial real estate is not an anomaly. It is a cyclical adjustment driven by sustained interest rate hikes, tighter credit standards, and softening valuations across most asset classes. For the first time in over a decade, cap rates are rising in a meaningful way. Investors and lenders alike are rethinking assumptions about growth, inflation, and risk.

Characteristics of Effective Leadership in CRE

This environment rewards discipline over exuberance. Operators who have been underwriting conservatively, building strong operational cultures, and maintaining flexibility in capital structures are better positioned to endure and even thrive in this cycle.

Success in commercial real estate during a reset hinges less on market timing and more on operational excellence. The following attributes consistently define effective leadership in down markets:

- Clarity of Strategy: Leaders must anchor their teams to a long-term investment thesis. Without a guiding philosophy, decision-making tends to become reactive and fragmented.

- Cultural Discipline: A resilient organizational culture supports sound judgment under pressure. It keeps teams aligned when external conditions are unstable.

- Communication: Transparent, timely, and honest communication with investors, lenders, and team members builds trust. In a reset, clarity beats charisma.

- Patience and Liquidity: The best opportunities often appear during the depths of uncertainty. Organizations with patient capital and liquidity reserves are uniquely equipped to seize them.

- Operational Rigor: Effective asset management and cost control become more valuable as revenue growth slows. Execution and attention to detail are critical differentiators.

Lessons from Past Downturns

Historical downturns, from the Global Financial Crisis to the early pandemic years, demonstrate that market resets serve as proving grounds. They separate firms that relied on favorable conditions from those that built resilience into their models. Real estate has always been a cyclical business. Successful operators design systems and teams with that fact in mind.

In past cycles, firms that acted decisively on discounted acquisitions, preserved capital during dislocations, and avoided overleverage were able to outperform as the market recovered. Conversely, firms that delayed decisions, denied market realities, or extended risk too far often faced permanent impairment.

Strategic Recommendations for CRE Professionals

Heading into 2025, commercial real estate leaders and operators should consider several proactive measures to navigate uncertainty:

- Rethink Growth Models: Re-evaluate assumptions about rent escalations, demand elasticity, and tenant credit strength.

- Model Downside Scenarios: Stress-test portfolios and underwriting for interest rate increases, NOI contractions, and exit cap rate pressure.

- Preserve Organizational Agility: Avoid rigid structures. Agility in capital deployment and asset management allows for faster adaptation.

- Focus on Talent and Morale: Retaining and motivating high-performing teams is essential during periods of stress. Leadership is as much about internal guidance as external strategy.

Navigating the Opportunity Within the Reset

Market resets are not just periods of loss. They are moments of recalibration. Firms that act with discipline, foresight, and integrity can emerge stronger. Many of the most enduring real estate legacies have been shaped not during the booms but during the downturns.

This period offers the opportunity for commercial real estate professionals to reaffirm principles, elevate execution, and lead with a focus on long-term value creation. While volatility tests systems and individuals alike, it also clears the field for those equipped to lead with skill, not speculation.