It seems to me that in today’s political and financial landscape, a confluence of tensions, policy shifts, heightened valuations, and market dynamics has elevated investment risks. What sparked this internal discussion for me was Buffett’s move to a liquidity environment.

Geopolitical Tensions and Trade Policies

The recent escalation in trade tensions, marked by President Trump’s imposition of a 10%, then 15%, then again 10% and now maybe 20% or 25% tariff on imports from Mexico and Canada and a 10% duty on Chinese imports, has introduced significant uncertainties. Trump’s impulsive and volatile approach to very sensitive trade discussions has created a lot of uncertainty. Uncertainty leads to volatility and more risk. Many experts believe these tariffs are anticipated to slow economic growth, elevate prices, and potentially lead to job losses. Economists caution that such policies could precipitate a recession by early next year, especially if retaliatory tariffs ensue. (marketwatch.com)

Goldman Sachs CEO David Solomon characterizes these tariffs as efforts to “level the playing field” in international trade. However, he acknowledges the heightened caution among business leaders due to the uncertainty surrounding their duration and impact. This sentiment underscores the broader apprehension permeating the market.

Market Volatility and Economic Indicators

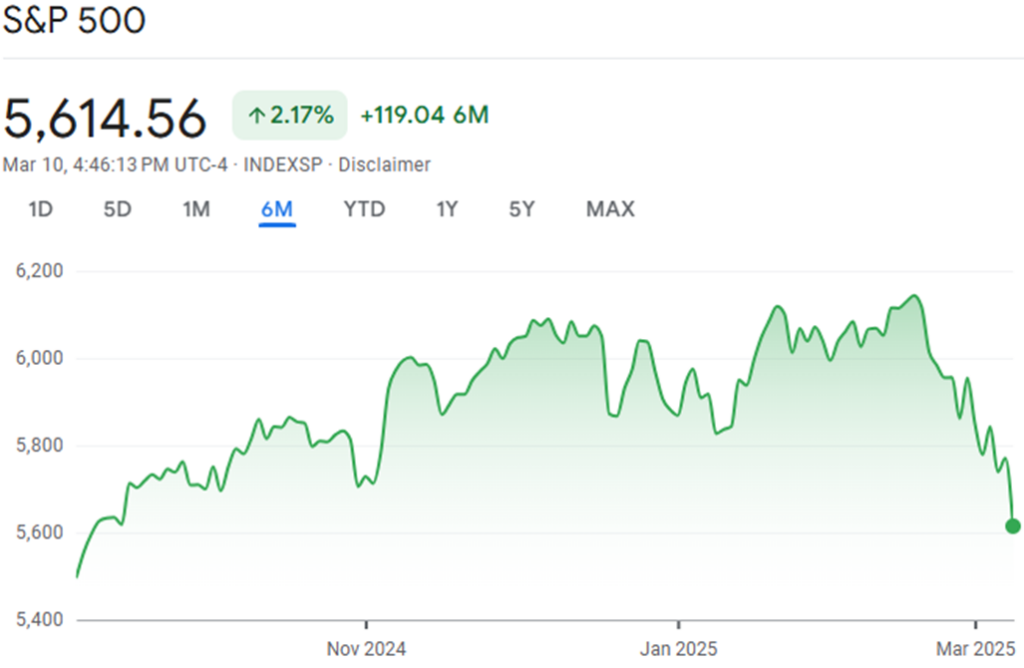

The financial markets have responded with notable volatility. Major indices, including the S&P 500 and Dow Jones Industrial Average, have experienced significant declines amid investor concerns about the economic implications of tariffs and a potential slowdown. The S&P 500 recently fell by 2.7% on March 10, 2025, closing at 5,614.56, reflecting the broader market’s trepidation. (AP News)

The chart below illustrates the recent performance of the S&P 500 Index over the past six months, highlighting key movements in response to evolving market conditions:

Stagflation and Historical Impact of Trade Wars

The term “stagflation” refers to the simultaneous occurrence of stagnant economic growth and high inflation. Trade wars have historically contributed to such conditions by disrupting supply chains, increasing production costs, and reducing consumer purchasing power. For instance, the tariffs imposed during the 1930s exacerbated the Great Depression by hindering international trade and elevating prices. (marketwatch.com)

There is a lot of historical data we can point to that shows trade and currency wars are not productive tools to resolve trade imbalances or geopolitical conflicts.

In the current context, there are concerns that ongoing trade disputes could lead to similar outcomes. The Bank for International Settlements warns that tariff-induced dollar appreciation could have stagflationary effects on the global economy due to the dollar’s dominant role in trade invoicing and international finance. (reuters.com)

Investment Strategies Amid Uncertainty

In light of these challenges, seasoned investors advocate for defensive investment strategies. Bill Gross, the “Bond King,” expresses anxiety about the current state of financial markets, citing fears of economic slowdown and rising inflation. He recommends investing in defensive stocks, such as tobacco companies like Altria and British American Tobacco, and telecom giants AT&T and Verizon, known for their resilient demand even in recessions and substantial dividend yields.

Similarly, strategist David Rosenberg advises emulating Warren Buffett’s conservative approach, emphasizing caution due to the unpredictable economic and political climate. He recommends focusing on cash, non-cyclical sectors like consumer staples, healthcare, and utilities, as well as bonds with intermediate durations.

Conclusion

The current market environment is fraught with heightened risks stemming from geopolitical tensions, trade policies, and economic indicators. When you couple all these risks with the fact that the stock market is trading at a very high PE multiple, compared to historical averages, and that we have not had a recession since 2008, excluding the Covid era, which is 17 years, and we usually have a recession every 7 years, the risks are evident. Investors are advised to adopt defensive strategies, emphasizing sectors with resilient demand and stable returns. Continuous monitoring of policy developments and economic indicators is essential to navigate these turbulent times effectively. I clearly see more risk in most markets, not just the stock market, and being very cautious.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.