Fed Tampering Signals Recovery: Questions for Real Estate

The US Federal Reserve Chairman Jerome Powell announced that the Federal Reserve would begin tapering its bond-buying program as the US economy continues to improve.

Despite an ongoing labor shortage, supply chain issues, and various COVID-related restrictions and mandates all affecting the economy, the Fed has determined that the time has come for the US economy to get back on its feet, albeit gradually.

The severity and timeframe of the policy change are not nearly as drastic as some headlines and predictions may have suggested. Chairman Powell has indicated that this taper will continue only so long as the economy continues to recover.

For those in commercial real estate, upon hearing this announcement, three questions come to mind:

- What has the Fed been doing in response to COVID?

- What does tapering mean in this sense?

- How will this tapering affect commercial real estate?

What Has the Fed Been Doing in Response to COVID?

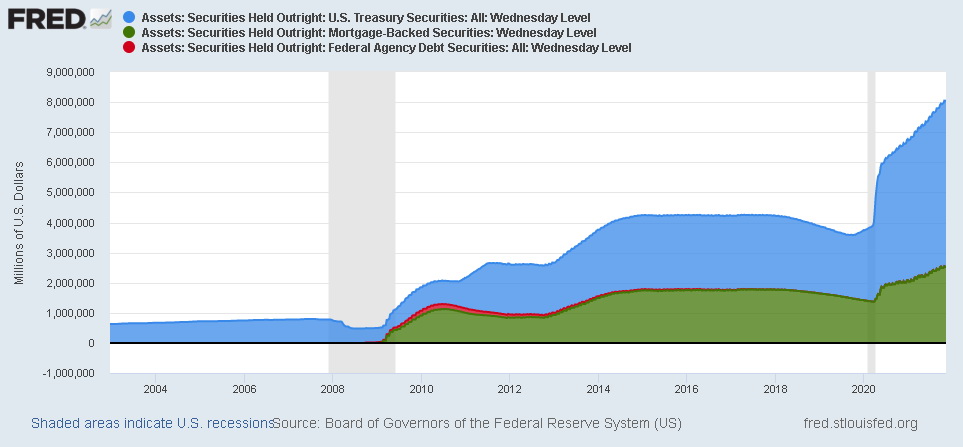

In March 2020, the Fed began buying $120 billion worth of bonds (a mixture of treasury and mortgage-backed securities) every month. This plan was designed to keep long-term interest rates low while also providing liquidity for the market.

See the graph below for a visual representation of this sudden increase in purchasing.

The inverse relationship between bond prices and interest rates allowed the Fed to effectively make borrowing cheaper for all entities across the market, regardless of size, by buying up more bonds.

Individuals were able to get affordable mortgage interest rates and continue making payments on them. Corporations and businesses of all sizes were able to obtain loans and issue debt without taking on unmanageable costs that would have only delayed inevitable failure instead of stopping it.

Beyond their ongoing bond-buying program, the Fed has taken quite a few actions to prevent COVID from bringing the economy and its financial institutions to a halt. For those interested in the specifics of these actions, the Brookings Institution has put together a thorough list of the actions taken thus far. It even includes some suggestions from former Fed chairs as to what could have been done during this unprecedented economic crisis.

In the interest of time, however, this entire list can be summarized by saying that the Fed made borrowing money cheap for the largest financial institutions, making it possible for these institutions to offer credit to individuals and businesses of all sizes.

What Does Tapering Mean with the Fed and Finance?

The Fed has announced that they will begin tapering their monthly bond purchases by $15 billion. This means that they will purchase $15 billion less in bonds each month than they had the month prior until they are making no bond purchases whatsoever, sometime in mid-2022.

The idea behind tapering is that by slowly and gradually reducing the amount of bonds purchased, the market will find its natural footing without a hard crash back to reality.

This is a delicate balancing act. While markets needed liquidity to continue functioning during the most uncertain periods of the COVID crisis, too much cheap and easy access to money can result in inflation.

As a result of this bond-buying program and the Fed’s decision to keep interest rates near zero, inflation has become a growing concern. It would be unfair to ignore the supply chain issues that are adding to the inflation problem, which are entirely beyond the Fed’s control.

To calm the market’s nerves, and despite the conversation about inflation, Chairman Powell made it clear that the federal funds rate would remain unchanged until the tapering program was complete. Further, the Chairman said that the Fed would remain vigilant of the tapering program’s effect on the economy and adjust accordingly.

How Will the Fed Tapering Affect Commercial Real Estate?

As the Fed begins tapering its bond-buying, the overall market for commercial real estate is expected to cool down. That said, it is important to acknowledge commercial real estate is a multi-faceted industry with various asset types that will behave differently in response to tapering measures.

The most simplistic connection between the Fed’s tapering and commercial real estate is the reality that interest rates on mortgages are ultimately going to rise. Regardless of what type or size asset a sponsor is attempting to purchase, debt servicing costs are likely to be higher in 2022 and 2023 than they have been since March 2020.

Multifamily assets are currently in extremely high demand due to low debt service costs, so investors should expect a slowdown as the Fed begins its tapering. This is not necessarily bad, as multifamily assets are arguably inflated and overdue for a correction. While this correction is sure to hurt investors who end up buying just before the coming peak, it will be a good thing for the market as a whole to have more realistically valued assets.

In terms of commercial office space, hotels, and retail, the effects are likely to be a continuation of trends that have already emerged due to the COVID pandemic. There will be more challenges for renting and selling in primary urban markets (New York, LA, Chicago). In contrast, secondary markets will grow as businesses seek new, more affordable locations.

With low occupancy rates in each asset type, the increased cost of borrowing will further drop the amount that owners can ask in rent and sales prices. Investors and businesses will be hesitant to get involved with new properties as the increased costs of obtaining capital will stress turning a profit in a shorter timeframe.

A Summary of the Fed Tapering Announcement’s Effect on Commercial Real Estate

The cost of borrowing will soon rise, but this will weed out investors who have, or would have, entered the market without a sound strategy for turning a profit. Commercial real estate requires accurate assessments of property values, and the Fed’s tapering will deliver just this.