In many industries, experts advise that the most effective and profitable careers require specializing in a particular niche especially when it comes to how to find real estate investment opportunities. Nowhere has this been more true than in real estate, where predictions often suggest that inexperienced investors are doomed for failure when venturing into unfamiliar territory; pick a lane and stay in it.

The belief that the unknown is inherently riskier than the familiar certainly protects against losses, but it also severely limits the chances for profits with real estate investments.

For that reason, it’s worth looking at some general principles in real estate investing that apply to all types of properties. Being aware of the forces that drive all types of real estate deals can help identify good opportunities while simultaneously avoiding risky investments.

Stay Open-Minded and Flexible to Capitalize on All Possible Real Estate Investment Opportunities

Before getting into any specific strategies, the most effective thing that can be done to maximize opportunities and profit in real estate is to recognize that there are always investment opportunities for those willing to look for them.

It’s easy to fall into a familiar groove when seeking out new real estate investments; staying close to what’s proven successful in the past is no guarantee of future returns. The mission of protecting against losses is understandable and commendable, but it’s a limiting mindset that can result in missed opportunities. Remember, there are profitable properties in all markets, not only familiar ones.

How We Find Real Estate Investment Opportunities

The path of progress is a concept that seeks to identify areas of current economic growth and predict where future opportunities may arise should those trends continue. These pathways of progress develop from economic, infrastructural, or policy changes, and often, it’s a combination of multiple factors. Agile investors identify these developing paths and place investments there.

Going beyond broad descriptions, here are some concrete examples of how a path of progress can develop.

- Economic growth patterns often emerge as individual industries take hold in a particular city. The most notable of these are the announcements of headquarters for large companies like Amazon and Tesla. This news alone can substantially change the economic characteristics of a city as well as the population and demographic trends.

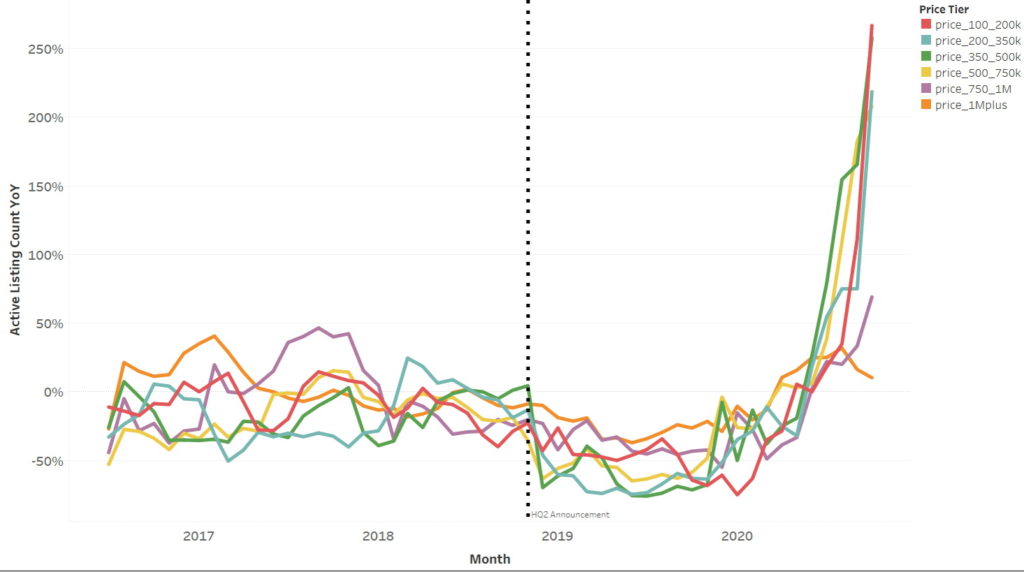

The graph below shows the effect that Amazon’s announcement of its HQ2 project had on the value of condos in Arlington, VA

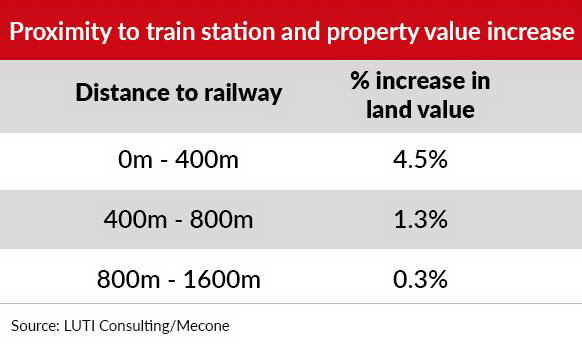

- Infrastructure projects can bring higher-paying jobs, growth, and stability to an area. There are many different examples of infrastructure (highways, ports, seawalls), but new rail lines are the most effective in clarifying the concept of the path of progress. When a new rail line is being built, such as the Los Angeles Metro, developers can predict the rise in demand around proposed station locations and invest confidently, knowing that demand, and consequently, value, will rise in those locations.

An article in The New Daily highlights this point as it discusses the direct correlation between rail transit and property values in Australian cities.

- Looking at policy changes, specifically, those surrounding opportunity zones, is the third way to predict future areas for investment. When governments offer significant tax benefits, like the complete elimination of capital gains taxes for real estate investors under certain conditions, this creates exceptional investment opportunities.

Regardless of the amount of the investment, market, asset class, or type, being on the path of progress is key to profitable investments that exceed expectations and deliver asymmetrical returns. When seeking out real estate investment opportunities, a handful of factors must be considered to ensure the property lies in areas where progress is soon to arrive.

Armed with the proper mindset of what creates a good investment, it’s possible to move on to identifying what variables need to be identified in order to locate these areas within states, cities, and even down to specific neighborhoods.

Predict and Detect Where People Are Going

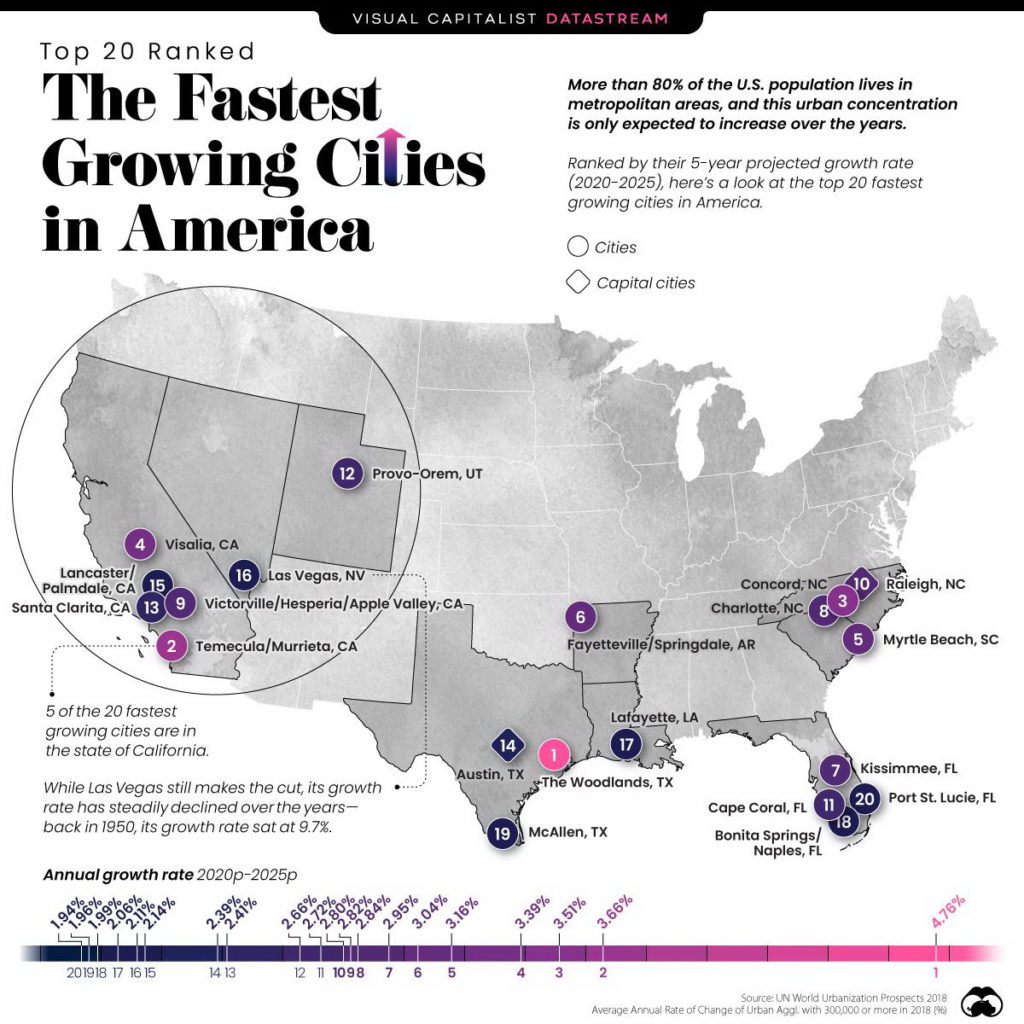

The first thing to consider is the population trends of an area under consideration. It’s easiest to begin by looking at the state level and seeing if the population is increasing or declining.

State population isn’t a tell-all variable, as a state can be losing population overall while still having a quickly growing city within its borders. That said, the population change of a state at large is a valuable indicator to know whether a state is on the path of progress or not.

From there, it’s possible to identify cities or areas that are attracting notable population growth. The reasons for potential growth can include corporate relocations or developments, cultural growth (becoming the “hot” city), or favorable taxation compared to other areas.

It’s not enough to talk about a city being a place worth investing in; get really specific and identify which areas of a city provide the most significant growth potential; this process is what makes it possible to discover the greatest value in a particular market.

Individuals, business owners, and even entire industries talk openly about their feelings regarding the value of particular areas. A little bit of active listening will inform which places are becoming difficult to live and work in and those which appear more attractive by the day.

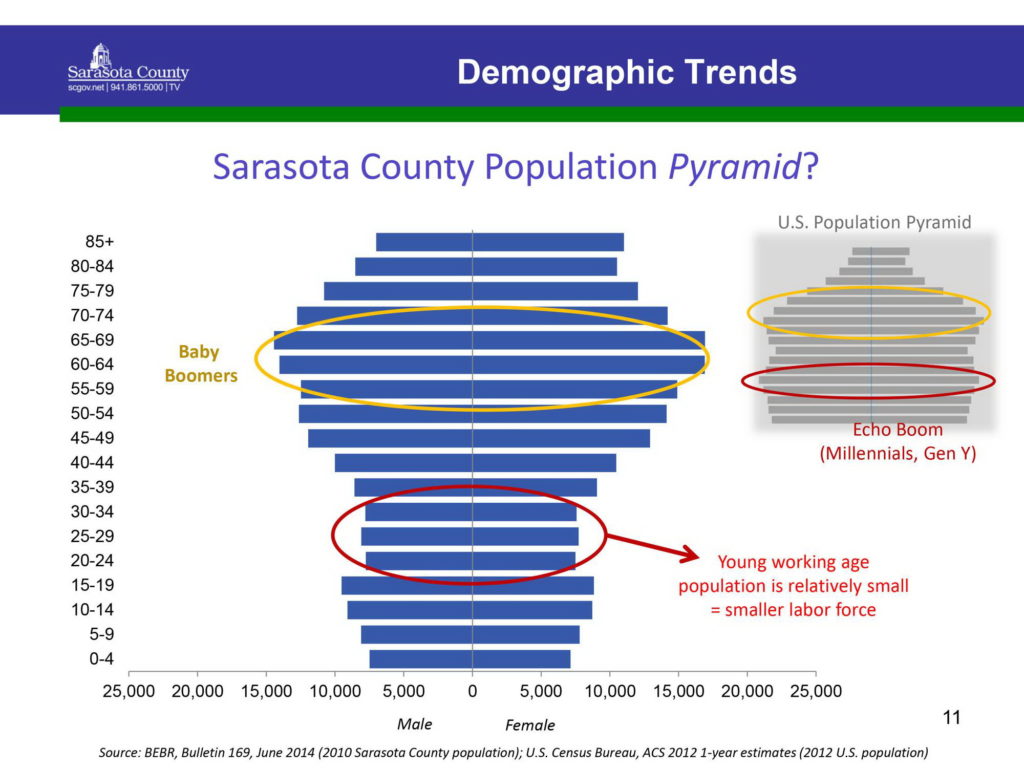

Consider Which Demographics Are Going

Besides the sum-total of people, consider which demographics are expected in terms of age and income levels. Paying attention to demographics can quickly and clearly frame which asset types and classes would be desirable and which would be a waste of time.

A clear-cut example would be how Sarasota County, FL, a popular retirement location, would likely be a terrible location for investments in any industrial property. Despite the 14.3% increase in population over the last decade, less than 50% of the population works, and it’s unlikely that many businesses will want to choose Sarasota as an area to start or expand their manufacturing. This is an instance in which simply looking at the soaring population isn’t enough to make an educated decision; it requires a more thorough look.

This is not to say that locations like Sarasota are without opportunity, every area has opportunity; it’s just about figuring out which direction the progress is heading. With its aging population, Sarasota would probably be an excellent location to invest in hospitals or professional office parks in which doctors need to establish their practices.

This is a very clear example of how demographics matter a lot when deciding what to invest in.

Understand Why They’re Going There

Along with the demographic of increasing populations, it’s valuable to know why particular people choose to relocate. With an understanding of why people are going to an area, it’s possible to get ahead of them and be waiting there with the exact properties they need to carry out their plans there.

This can mean anything from urban office space to multi-family rentals to industrial properties. It all depends on the current trends.

Underwriting Fundamentals

Behind all these variables is the great denominator of real estate investing; underwriting. As StarPoint Founder and CEO Paul Daneshrad says,

“When you’re evaluating real estate, whether it’s an apartment building or an office building or an industrial asset, you’re underwriting risk. Risk in the income stream, risk in the asset, risk in the physical structure, risk to your tenant base. Then as you’re evaluating risks, you’re hedging those risks with not only opportunities but also limitations on the downside. So that falls under the broad spectrum of just what we call underwriting and risk analysis.”

Identify Micro-Markets of Value and Act Now

Considering which locations are growing, who’s causing them to grow, and their motivation makes it possible to identify micro-markets to invest in. Micro-markets are simply a term for the area, asset type, and targeted demographic and economic conditions that dictate the properties to purchase.

Here at StarPoint, we have identified Austin, TX, as providing an excellent opportunity for investment.

We like apartments and Austin has great job formation, high-paying jobs, high quality of living, temperate climate, and massive corporate relocations (that goes back to job formation…). From there, we drill down on the micro pockets we want to be in in the city.

We identified over ten years ago that Austin multi-family was going to do really, really well and before it took off we started buying there. Where we started buying was right around the Apple Mega Campus. Why? Because this billion-dollar development was going to eventually have 15,000 high-paid employees. Most of them will be renters, and they’re going to be renters by choice, which means a lot of disposable income for apartments.

Anything we bought there early on just sort of exploded because we picked our market, picked our asset type, and picked our micro-market.

Let Market Inefficiencies and Bad Value Guide Smart Purchases

Beyond simply finding a micro-market that seems promising for investment, find the inefficiencies within it. When it’s difficult for consumers to find good value in a particular asset type or class (or both), this is an opportunity for real estate investors to make purchases that allow them to deliver the value that the market is missing.

Determining that an area lies in the path of progress isn’t the only factor in deciding which properties to invest in. In addition to the region, city, asset type, and asset class, investors also need to determine if they can provide value to consumers that doesn’t currently exist.

In the instances that the properties needed to support the incoming growth are already there and competitively priced, where’s the opportunity? There isn’t one, and it’s best to move on in these cases!

Letting the presence of inefficiencies dictate whether to make purchases removes a lot of the emotional nature from the purchase process and makes it much more mathematical, logical, and profitable.

A Case Study in Finding Inefficiencies

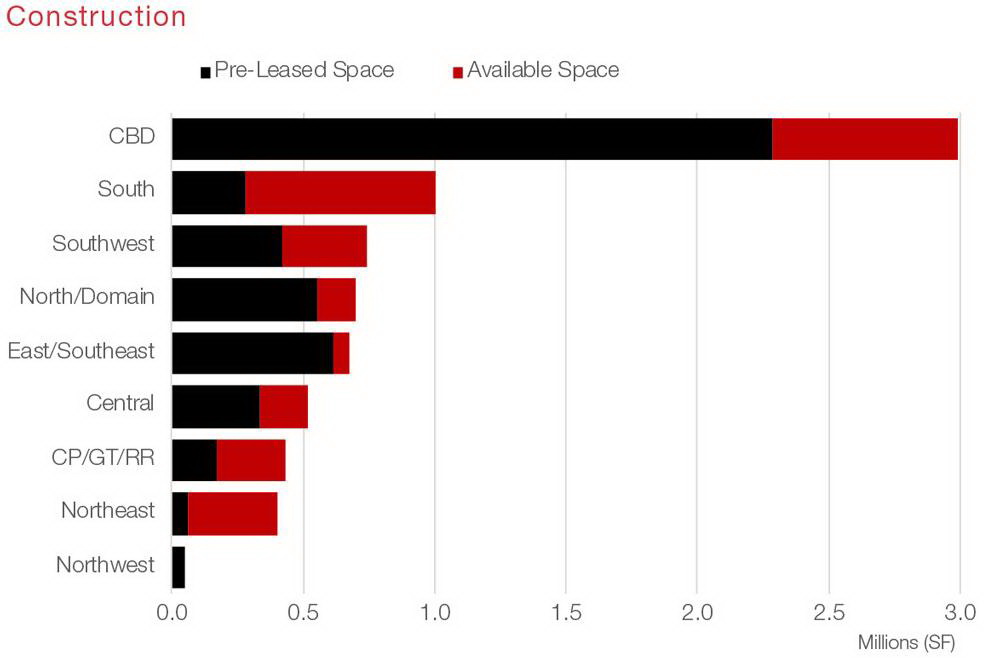

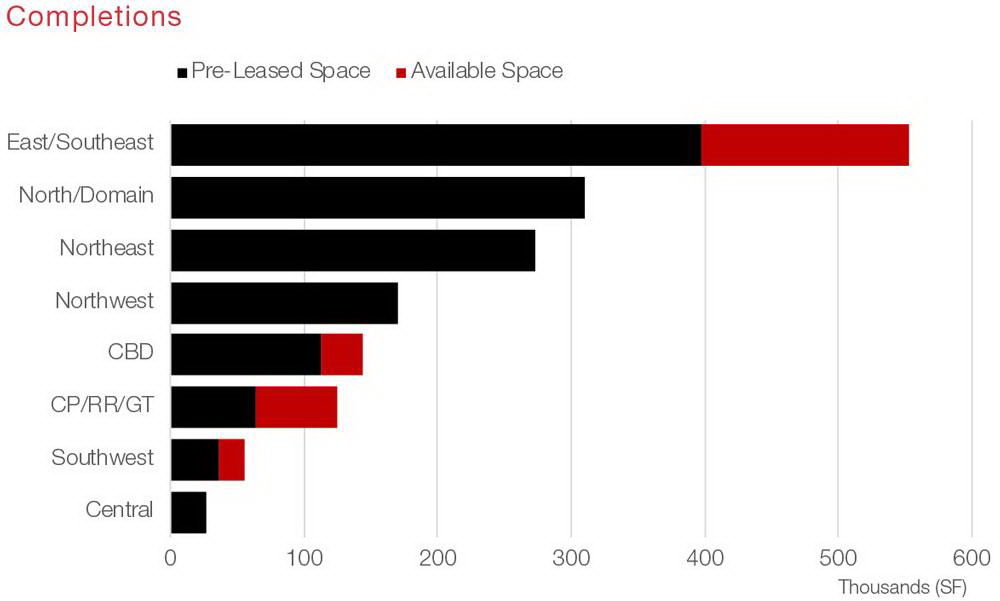

Going right to the data is most effective in finding market inefficiencies. The charts below are from 2019, so they’re just to give a representation of these ideas.

The two charts above show the office space under construction and completed in Austin, by region. When looking at these two charts, it’s clear that the northwest of the city remains underserved and is an excellent area to invest in.

Unsurprisingly, since the release of the report above, more office space, mixed-use residential/commercial space, and even a sports stadium have opened.

Don’t Be a Hero, Hire Specialists When Necessary

Applying demographic analysis and thorough underwriting practices takes a lot of the guesswork out of any new acquisitions, but it’s important to hire help when it’s needed. We don’t claim to be experts in everything, and when we see a gap in our corporate skillset that needs filling to capitalize on an opportunity we’ll hire someone who is.

By working hard and smart and by bringing in world-class talent, we can identify asymmetrical return opportunities and go after them. Many of the processes in real estate investment opportunities will be the same, regardless of the size of the investment, building, asset type, or class. Still, there will be asset-specific knowledge that can escape a new investor’s understanding and can make the difference between mediocre and exceptional returns. Knowing the limitations of one’s own experiences is just as important as the experiences themselves.

Keep Focus on Net Returns, Not Gross

Keeping the focus on net returns instead of gross returns is crucial when choosing micro-markets and specific investments. The initial underwriting process should extensively consider all possible tax incentives/liabilities, maintenance, or rehabilitation costs that could end up affecting the bottom line.

It can be misleading to look at the profits without considering what expenditures are accompanying them in the near future, particularly the after-tax result of an investment which is, after all, the only thing that matters to investors – how much they keep in their pocket and out of Uncle Sam’s. Stressing this point, a seasoned underwriter can help paint an accurate picture of the costs and risks of any given property.

Beyond All Else, Stay Learning and Remain Teachable

The most talented investors all seem to have one thing in common, they don’t act as though they’ve arrived and quit working. Markets, strategies, and trends are always in flux, and even the most successful people keep their finger on the pulse of their industry.

Just because there are opportunities in a particular asset type today doesn’t mean it will be that way forever. In contrast to what many would suggest, it’s probably in those moments of success that it’s best to pick up new knowledge for when that success inevitably fades. Stay sharp, stay dynamic, and stay teachable to be prepared for the next big opportunity.