Unlocking Tax Benefits

What if you didn’t have to pay capital gains taxes on your real estate investments? Being able to eliminate capital gains taxes was once a dream scenario for real estate investors. However, thanks to the introduction of Qualified Opportunity Zone legislation, it’s now a dream that has come true. The bipartisan bill that was created to drive economic growth in undercapitalized, underfunded areas is also an opportunity that investors have been searching for. Obviously, as is the case with any government-introduced program, we aren’t entirely sure how long Opportunity Zones will be around, which means time is of the essence. It also means that if you don’t take advantage of these opportunities now, you may regret it later on.1

While shorter-term investments (those lasting between five and seven years) come with tax deferral options in place,2 investors who commit to investing in Qualified Opportunity Zones for more than ten years can put themselves in a position to not have to pay any taxes on the funds generated by the investment. If your investing with an eye toward the future, investing in one of these areas is a must.

In order to achieve optimal success as an investor, it’s important that you fully understand all of the options you have at your disposal. While some investors focus only on the stock market and others focus only on owning rental properties, the most successful investors load their portfolios with diverse investment options that not only create multiple revenue streams, but also protects them in the event that one of their chosen asset classes suffers a financial downturn. Within the realm of any investment class, there are several subsections. One such example is found within the world of real estate. While fix-and-flip, rental properties, and commercial ownership are all viable options, real estate investors should also understand what opportunity zones are and the benefits of investing in them.

What are Opportunity Zones?

Qualified Opportunity Zones, also referred to as QOZs, are the result of a bipartisan policy that was passed into law on December 22, 2017. The creation of Qualified Opportunity Zones was the result of the Tax Cuts and Jobs Act, a bipartisan bill that was created and signed into law in order to stimulate the economy. According to the IRS website, the first wave of QOZ designations, which covered parts of 18 states, were officially designated on April 9, 2018. In addition to the officially designated areas in those 18 states, other zones covering the remaining 32 states and five US territories.

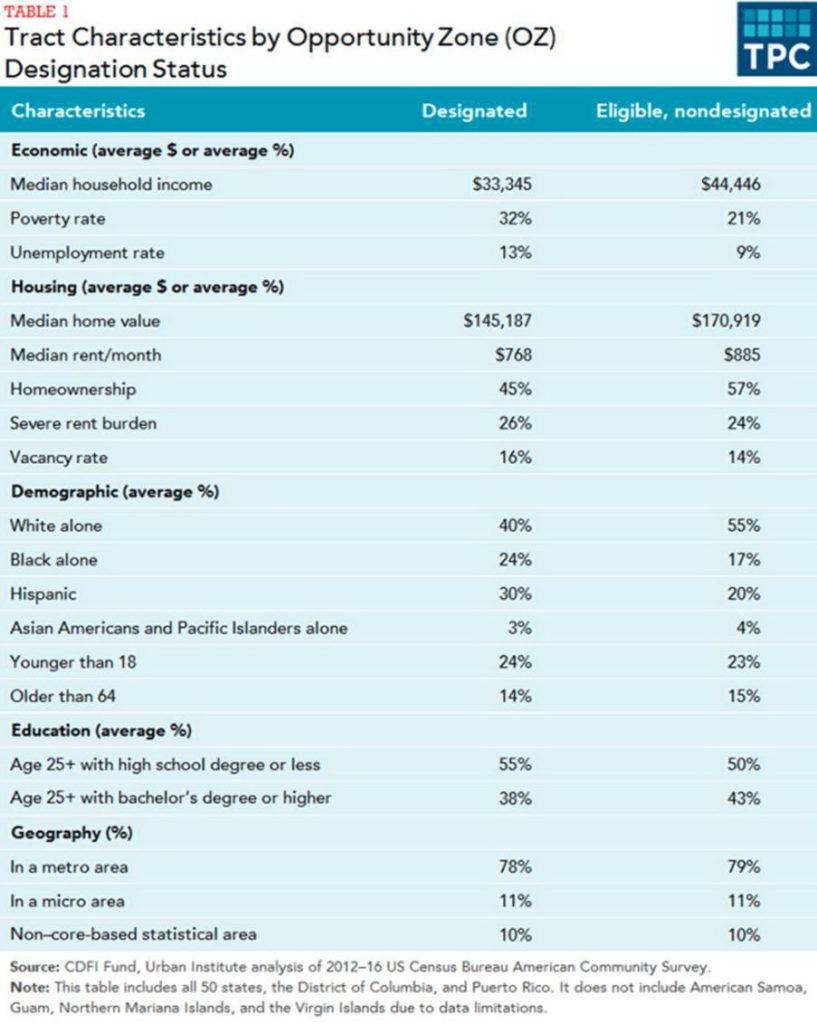

As seen in the table, both rural and urban opportunity zones closely tracks community patterns.

There are certain criteria that must be met for an area to be considered a Qualified Opportunity Zone. Primarily, an area must be considered low-income and undercapitalized. The criteria that is used to determine an area’s status as low income and undercapitalized are set forth by the US Secretary of State and the United States Treasury Department.

The ultimate goal of these zones is to provide economic growth in areas that are in need of jobs and capital. When investors can derive tax-related benefits, which will discuss in a moment, for investing in these areas, they are more apt to provide the funds necessary to improve the area, open new businesses, and provide other sources of financial increase. Today, the United States has more than 8,700 QOZs, and a list of them can be found on the United States Department of Housing and Urban Development website. (https://www.statsamerica.org/opportunity/). A person or entity who wants to invest in one of these Qualified Opportunity Zones simply must file IRS Form 8896 with their federal tax return. There are rules in place that dictate how the person or entity must manage the investments received, primarily that they must invest at least 90% of the funds generated into approved assets within the opportunity zone.

How Do Qualified Opportunity Zones Work?

Once an area has been designated as a Qualified Opportunity Zone, any person or entity can file the paperwork necessary to create a Qualified Opportunity Fund. Once the fund has received official recognition by the federal government, investors can begin investing recognized capital gains into the fund to receive tax-deferred status on those gains.

Investors do not have to live, work, or own a business in the area where a Qualified Opportunity Fund is being used. Any investor can invest in any QOZ, regardless of location. As an investor, you can elect to defer your gain, whether in whole or in part, by filing the necessary paperwork with your personal tax return, including verifiable evidence that you invested into a QOF of your choosing.

What Are the Benefits of Qualified Opportunity Zone Investing?

Obviously, investors want to take advantage of tax incentives when possible. In order to make Qualified Opportunity Zones more appealing to investors, policymakers put tax breaks in place. First of all, any investor or entity can take unrealized capital gains and invest them into an opportunity fund. Recognized gains must be invested into a QOF within 180 days. The QOF must then meet certain balance sheet requirements on QOZ-eligible holdings on periodic testing dates thereafter.

An investor who receives a capital gain from another investment from a flow-through entity, such as an S-corporation, a partnership, or a trust/estate has 180 days from the end of the year to reinvest those funds into a QOZ. This requirement does not change based on how early in the year that capital gain was realized. For instance, if an investor realized a capital gain in February of 2021, his or her 180-day window does not start until December 31, 2021.

The primary benefit for investors is found in the ability to defer taxes owed on capital gains. In addition to deferring taxation on the capital gains that you used to fund your investment into a QOZ, you can also defer the profits generated by your investment, as long as you reinvest those funds into the Qualified Opportunity Fund.

If an investment in a QOZ is held for more than five years, the investor can receive a 10% exclusion of the deferred gain on their investment. Investors who intended to hold their investment for more than seven years were able to receive a 15% exclusion – though this benefit has already expired. Finally, investors who hold their investment for more than ten years will not owe any federal income tax on the fund’s appreciation by the date of sale.

Plenty of Rules but Lots of Opportunity

There are certain rules that Qualified Opportunity Fund managers must adhere to. As discussed earlier, the Qualified Opportunity Fund must invest no less than 90% of their funds into the Qualified Opportunity Zone. However, it’s important to note that there are certain types of businesses that cannot be opened or invested in through a QOF. Golf clubs, country clubs, liquor stores, racetracks, massage parlors, and other businesses are not eligible for QOF funding. Additionally, the QOF must use the funds generated to purchase property, buildings, or equipment that will be used for the opening, remodeling, or operation of the businesses within the QOZ.

Qualified Opportunity Zones are a great tool for investors who take a long-term approach to their investing. The tax-deferral benefits associated with investing in these zones makes them incredibly appealing to investors while also providing much needed economic improvement for underfunded, undercapitalized areas.

[1] Guidance right now is until 12/31/2028. That said, it may be shut down prior to this date (given the tumultuous environment of our federal government).

[2] 7 year benefit already expired. 5 year, 10% reduction benefit expires 12/31/2021.