The Debt Ceiling: What It’s Supposed to Be

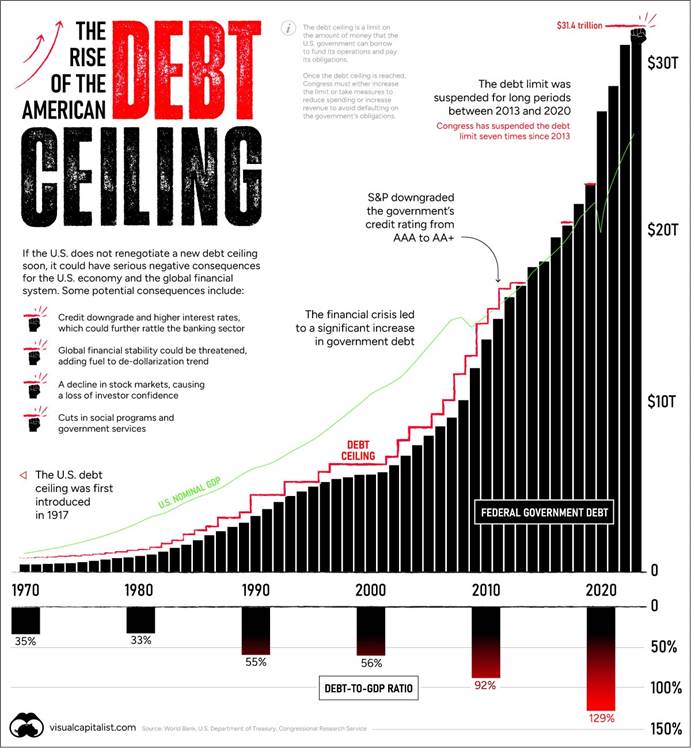

The US debt ceiling was never designed to be a revolving line of credit. It was a speed bump, a tool Congress created in 1917 to limit how much the federal government could borrow without getting explicit approval every time.

In theory, it’s meant to prevent runaway debt.

In practice? It’s become a rubber stamp for fiscal irresponsibility.

Every time we hit the limit, we raise it. Then we hit it again. Then we raise it again.

Rinse. Repeat. Deny. Pretend.

The Scorecard: How Many Times Have We Raised It?

Let’s deal in facts:

The US has raised its debt ceiling more than 100 times since it was introduced.

That includes 90+ raises since 1940 alone. Think about that.

If you kept asking your bank to raise your credit limit every few months, they’d eventually cut you off. But the federal government? They just keep increasing the limit with zero intent to stop spending.

Here’s a graph that tracks every increase alongside our national debt. Spoiler: The two lines move in sync, always up.

What Happens When We Keep Raising It?

Let me be direct: This doesn’t end well.

Here’s what we’re already seeing, and it will only get worse:

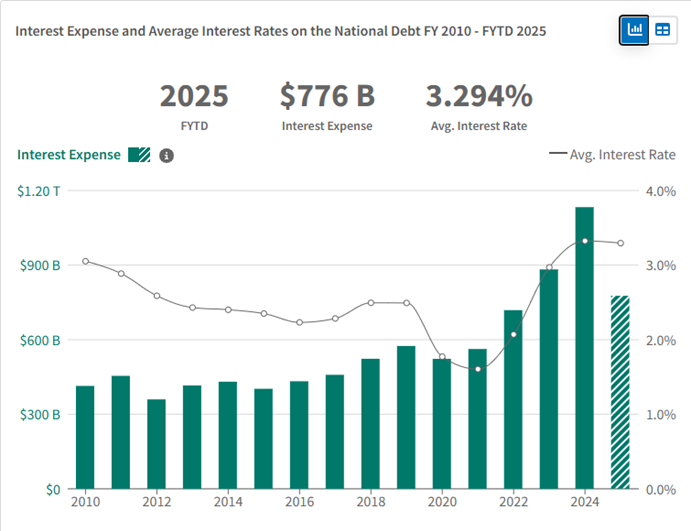

1. Interest on the Debt Becomes a Dominant Expense

We’re now spending over $1 trillion annually on interest payments. That’s more than defense. More than Medicare. And we’re just getting started.

2. Inflation Becomes Structural, Not Cyclical

When you borrow this much, someone has to buy the debt. When they don’t, the Fed prints money to cover it. That’s monetary inflation, and it’s not temporary.

3. Creditors Get Nervous

If investors stop believing the US. can live within its means, they demand higher interest rates. That accelerates debt costs and ignites a full-blown confidence crisis.

4. The Dollar’s Global Dominance Erodes

You can’t lead the world with a currency built on IOUs. Eventually, something gives, and when it does, it will make 2008 look like a warmup act.

Why Politicians Keep Doing It Anyway

Because they can. Because the consequences aren’t immediate. And because voters reward promises, not discipline.

Here’s what no one on Capitol Hill will say out loud:

“We don’t know how to stop. And we’ll be long gone by the time the bill comes due.”

They’ll say it’s necessary. They’ll say it’s about saving Social Security or preventing default. But the truth is simpler: They lack the courage to cut spending.

What You Should Do About It

Let’s be honest, you’re not going to fix Washington. But you can make sure Washington doesn’t wreck your future.

Start by thinking like a producer, not a consumer:

- Save more than you think you need

- Invest in productive, real assets

- Stop relying on the government for your outcome

- Focus on asymmetrical returns: low risk, high upside

- Build wealth in a way that’s independent of politics or policy

Final Thoughts

If you ran your personal finances like the US government, you’d be bankrupt and unemployable. The debt ceiling is a farce, a meaningless ritual we repeat to feel like someone’s in control.

But no one is. And that’s the point.

You need to be the one in control.

Because when this house of cards starts to wobble, the only safety net is the one you built yourself.